Making Sense of the ITC Labour Requirements

Author: Rachelle Lynne-Davies, P.Eng.

The second in a series of ITC blogs from Compass Energy Consulting

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon

Compliance with the ITC labour requirements is critical to securing the full value of the Clean Technology Investment Tax Credit (“Clean Tech ITC”). Non-compliance could mean additional financial penalties in addition to putting your ITC eligibility at risk.

As we discussed previously, the Clean Tech ITC incentivizes the deployment of renewables and energy storage in Canada by offering an up-to 30% tax credit for investments in eligible renewable energy projects. The regular tax credit rate requires compliance with the labour requirements for an added 10% portion. The reduced tax credit rate refers to the 20% base.

The labour requirements consist of two compliance obligations for covered workers: 1) prevailing wage requirement, and 2) apprenticeship requirement.

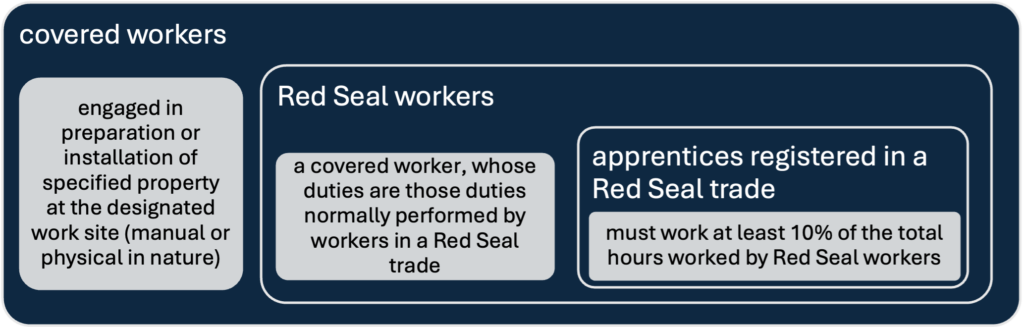

Covered Workers

It is important to note that not all on-site labourers are covered workers. Covered workers are those on-site labourers that are engaged in the preparation or installation of specified property at a designated work site, whose duties are primarily manual or physical in nature, and who is not administrative, clerical, an executive employee, or a business visitor to Canada.

Specified property (or “Clean Technology Property”) in the definition of a covered worker refers to the eligible properties under the Clean Tech ITC. As per section 127.46 subsection (3) of the federal legislation, covered workers must be paid prevailing wages for their labour on-site.

Prevailing Wage Requirement

Covered workers must be paid prevailing wages according to: i) the terms of an eligible collective agreement that applies to the worker or ii) in an amount that is at least equal to the terms of an eligible collective agreement that most closely aligns with the covered worker’s experience level, tasks and location. See Figure below.

Figure 1. Covered Worker Diagram

If the covered workers at your designated work site are not union workers, they will be required to be paid prevailing wages at least equal to the most recent multi-employee collective bargaining agreement negotiated with a trade union (that is an affiliate of Canada’s Building Trades Unions) for a given trade in a region or province or similar Project Labour Agreement (“PLA”) or prescribed agreement.

The incentive claimant is ultimately responsible for the compliance of all covered workers on-site. The incentive claimant or taxpayer must attest that not only has it met the prevailing wage requirement for its own employees that are covered workers (if any), but that it has taken reasonable steps to ensure that any covered workers employed by any other person or partnership at the designated work site are compensated accordingly.

Additionally, to ensure that on-site covered workers are aware of this prevailing wage requirement, it must be communicated, via poster or notice, that is visible and accessible to on-site covered workers (physical or electronic), that confirms that the work site is subject to prevailing wage requirements in relation to covered workers. This notice must include a plain language explanation of what that means for workers and information regarding how to report failures to pay prevailing wages to the Minister.

Apprenticeship Requirement

The federal legislation (127.46 subsection (5)) requires that apprentices registered in a Red Seal trade work at least 10% of the total hours that are worked during the year by Red Seal workers at a designated work site of the incentive claimant on the preparation or installation of specified property.

This compliance requirement necessitates the continuous tracking of labour hours by all Red Seal workers, which may be a subset of covered workers, and apprentices registered in a Red Seal trade to ensure that the minimum 10% apprenticeship target remains on track. Not all on-site preparation and installation of specified property may be duties that are normally performed by workers in a Red Seal trade or other equivalent provincially registered trade. See Figure below.

Figure 2. Relationship of Apprentice Hours to Red Seal Workers to Covered Workers

Adjustments to the 10% apprenticeship target may only be made if an applicable law or collective agreement either specifies a maximum ratio of apprentices to journeypersons or otherwise restricts the number of apprentices on-site. However, the incentive claimant must make reasonable efforts to ensure that the highest possible percentage of the total labour hours performed by Red Seal workers is performed by apprentices registered in a Red Seal trade, while respecting the applicable law or collective agreement.

The incentive claimant is ultimately responsible for the compliance with the 10% apprenticeship requirement for itself, its EPC contractor, and all applicable subcontractors. The incentive claimant or taxpayer must attest that it has met the apprenticeship requirement in respect of covered workers at the designated work site.

Structured Compliance Approach

A structured compliance approach includes establishing a structured plan that sets out requirements, expectations, and targets, conducting monitoring activities at regular intervals to ensure transparency of meeting targets, and utilizing an effective data management system for labour records, which will form the audit binder and be readily available in the event of an audit.

Since the incentive claimant is ultimately responsible for compliance with the labour requirements, it is imperative that a compliance plan is established and communicated through the on-site labour supply chain. It will be critical that the timing of establishing this compliance plan occurs prior to execution of the EPC agreement. It will be critical that the EPC contractor, and in turn all subcontractors, are contractually bound to meet the requirements of prevailing wage and apprenticeship. Part of compliance planning will include establishing the on-site labour supply chain and the approach each on-site contractor will take to meet the labour requirements.

Compliance monitoring will be a critical continuous activity to track on-going compliance and forecast compliance to meet the established targets. Labour hours must be tracked by employee along with a description of the employee’s work duties on-site, the compensation rate, status of Red Seal worker certification or status of apprenticeship registration in a Red Seal trade (as applicable). These labour hour records will be compiled on a monthly basis to track compliance with applicable prevailing wages, total labour hours provided by Red Seal workers, and total labour hours provided by apprentices registered in a Red Seal trade. Compliance monitoring on a monthly basis enables compliance gaps to be identified and rectified before it’s too late.

Compliance evidence will be collected in advance of and throughout the construction period. See Table below for types of compliance evidence that may be included.

Table 1. Compliance Evidence by Requirement

| Compliance Requirement | Compliance Evidence |

| On-site labour supply chain, including EPC contractor and applicable subcontractors, are contractually bound to meet the labour requirements |

|

| EPC contractor and applicable subcontractors are required to pay covered workers the applicable prevailing wage |

|

| EPC contractor and applicable subcontractors are required to meet or exceed the 10% apprenticeship requirement |

|

The Need for Compliance Management Support

It would be detrimental to project stakeholders to misinterpret the eligible and ineligible properties that are defined as Clean Tech Property (or specified property), as it could lead to additional project costs for prevailing wages that are not required, and perhaps more importantly, it could artificially inflate the total Clean Tech ITC that the taxpayer is relying on. Not only would you be including ineligible properties in the capital cost calculation, but you would be paying a premium for the labour and installation of those ineligible properties, all of which is not claimable under the Clean Tech ITC.

The labour and apprenticeship requirements give rise to the need for compliance planning, monitoring, and data management of evidence.

Why Compass Energy Consulting?

Founded in 2011, Compass has been providing regulatory and compliance support to the renewable energy marketplace throughout Canada and the Northeastern U.S. for over a decade. Compass’ founders helped to design some of the largest Domestic Content compliance obligations for renewable energy procurements, like those found in Ontario’s Feed-in Tariff program, and our team of consultants help developers participate and win in some of the largest procurements, like NYSERDA’s Tier 1 REC RFP.

Compass is uniquely positioned to provide a turn-key compliance, monitoring, and audit service due to our experience providing these types of services to over 200 MW of projects under Ontario’s Feed-in Tariff 1 and 2 Domestic Content compliance regime. Our compliance assessments were provided for project owners but importantly were relied upon by project lenders to ensure projects satisfied this critical and binary contractual obligation.

Compass Energy Consulting is your insurance policy for your ITC. Feel free to reach out to me at rachelle@compassenergyconsulting.ca to discuss further.

Check Out Our Next Blog in the ITC Series

Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon