Secure the Full Value of Your Tax Credit

…Through Compliance Implementation & Monitoring

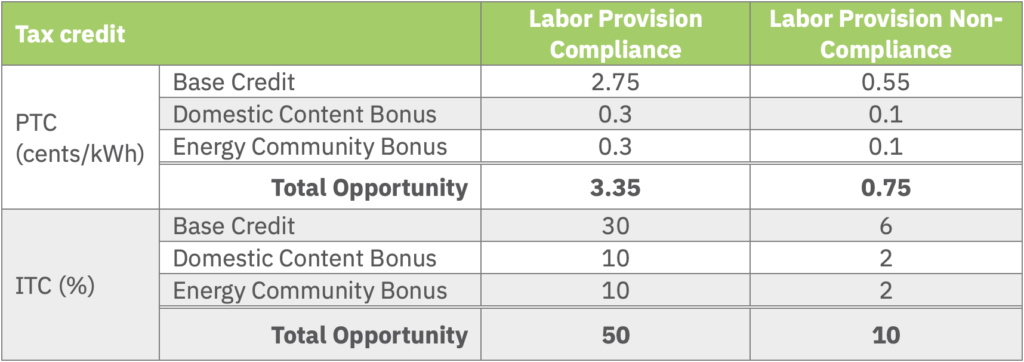

A critical piece of a project’s economics going forward is obtaining the tax credit introduced in the Inflation Reduction Act (IRA).

- Investment Tax Credit (ITC): provides a tax credit on business investments in renewable energy development in a given tax year.

- Production Tax Credit (PTC): provides a credit per kilowatt-hour (kWh) of electricity that is produced for the 10-year timeframe starting from the in-service date.

- Additional credit bonuses of 10% each are available for projects that meet specific Domestic Content requirements OR for siting a project in an Energy Community.

Example: 500MW portfolio, assumed to have development costs that exceed $500 million USD, obtaining full ITC and bonus credits would equate to an estimated tax credit value of $250 million USD.

The prevailing wage and apprenticeship provisions (the “labor provisions”) affect the value of the tax credit in two distinct ways:

- the base credit value, and

- any applicable bonus credit value(s).

Compliance with the labor provisions offers a 5x increased value to the base credit and bonuses.*

* Due to rounding to the nearest 0.05, as directed by the IRS Code, the PTC bonuses without compliance with the labor provisions are inflated from 0.06 cents/kWh to 0.1 cents/kWh.

With this much at stake, it’s critical for your investors that there is a structured and vetted approach to ensuring your Engineering, Procurement and Construction (EPC) contractor meets or exceeds the minimum requirements embedded in the Internal Revenue Code (IRC) requirements.

Example cont’d: for the 500MW portfolio, non-compliance with the labor provisions would represent a lost opportunity of $200 million USD.

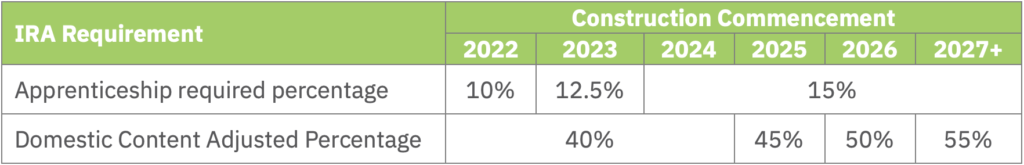

Adjustments to the Compliance Requirements Over Time

The Internal Revenue Codes (IRC) 45, 45Y, 48, and 48E (“the Codes”) describe the compliance requirements to achieve the target tax credits for the production tax credit and investment tax credit, respectively, for projects placed in service after December 31, 2022 and after December 31, 2024, respectively. The compliance requirements change over time across the IRA requirements. The table below summarizes the changes to the compliance requirements over time.

- Prevailing Wage: The prevailing wage compliance requirements are maintained across the Codes for PTC & ITC and inherently require compliance with the current rates per locationality. The prevailing wages applied should be most recently determined by the Secretary of Labor, in accordance with subchapter IV of chapter 31 of title 40, United States Code. For the PTC, the compliance period is 10 years from the in-service date, whereas the ITC requires a 5-year period.

- Apprenticeship: The apprenticeship compliance requirements are maintained across the Codes for PTC & ITC with the required percentage of labor hours performed by qualified apprentices currently at 12.5% for projects beginning construction in 2023 and increasing to 15% for projects beginning construction in 2024 and after.

IMPORTANT: Each “contractor with 4+ employees performing construction, alteration, or repair work on a project shall employ 1 or more qualified apprentices to perform such work.” Consequently, the apprenticeship requirement cannot be concentrated to one contractor and must be shared across the on-site construction supply chain, as applicable.

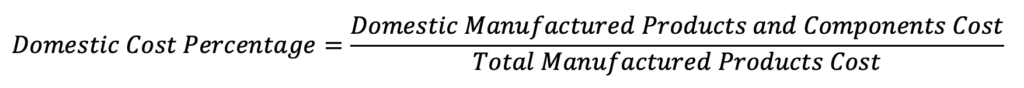

- Domestic Content: The Codes have the same or very similar compliance requirements for Domestic Content across PTC & ITC. The Adjusted Percentage, currently at 40%, sets the minimum required Domestic Cost Percentage for the project, calculation shown below. The Domestic Cost Percentage for the project must be greater than the Adjusted Percentage.

The Adjusted Percentage increases by 5% per year starting in 2025, to a maximum of 55% for projects beginning construction in 2027 and after.

The Codes indicate that permanent records must be kept, and that the Secretary reserves the right to audit throughout the life of the project. Ensuring that contractual requirements related to the IRA requirements are met across a portfolio of projects will require a structured and meticulous approach towards compliance, implementation, and record keeping.

Audit-proof your portfolio. Reach out to Compass Energy Consulting to learn more about how we can support your compliance plan, implementation, and record keeping.

A fulsome compliance plan and implementation approach necessitates a multi-phase approach that includes pre-assessment, process auditing, as well as on-going monitoring and reporting, and will form an insurance policy that the significant tax credit available is bankable for investors and project stakeholders. Compass’ approach incorporates the following 7 tasks:

Task 1 – Pre-Construction Compliance Planning: will focus on setting the groundwork for the compliance implementation, monitoring, and reporting. The Compliance Plan must be prepared with project specific inputs including construction and equipment supply chains chosen or contemplated. Contractual obligations will be identified, and specific language will be furnished for the EPC Agreements and passed down through subsequent supply chain agreements. Template labor hour timesheets will be prepared for use on-site, as well as determining sufficient qualified apprenticeship evidence.

Task 2 – Domestic Cost Percentage Determination: will include data requisition from specified supply chain vendors. The first step is to determine all Applicable Project Components. Table 2 of the IRS Guidance on Domestic Content provides a starting point for that list. Direct costs will be required from all Manufactured Product vendors and all sub-vendors that provide U.S. Manufactured Product Components. Compass Energy Consulting can act as a third party to the manufacturers so that cost information remains confidential. The compliance approach and target Domestic Cost Percentage will be determined in conjunction with the procurement plan to ensure it is greater than the adjusted percentage.

Task 3 – Annual Prevailing Wage Determination: will focus on the annual determination of the applicable prevailing wages for the construction, alteration, or repair work expected on-site for that calendar year. The prevailing wages will be set as most recently determined by the Secretary of Labor, in accordance with subchapter IV of chapter 31 of title 40, United States Code. This process will be required through construction and a portion of operation.

Task 4 – Monthly Compliance Reporting: will include monthly compliance progress reports on adherence to the labor provisions and Domestic Content requirements progress. The monthly reports will identify any gaps in compliance with applicable next steps to realign compliance.

Task 5 – Manufacturing Supply Chain In-Person and Desktop Audits: will focus on in-person auditing of selected equipment suppliers and service providers to ensure they are capable of both satisfying the contractual requirements embedded the IRC and have appropriate information management systems in place to be able to substantiate compliance. A report will be produced for each equipment supplier audit. The desktop audits will ensure that the records provided are complete and accurate by reconciling production, shipping, and invoice records with purchase orders. A structured data management system will be created to retain all records electronically. These records will form part of the Domestic Content Report and Audit Binder and remain as evidence of Domestic Content compliance in the event of an audit.

Task 6 – On-Site Project Audit: will include visiting the project site to ensure labor hour tracking compliance, retention of qualified apprenticeship evidence, and ensuring major equipment deliveries are being recorded appropriately to ensure traceability to U.S. production records.

Task 7 – Labor Provisions and Domestic Content Audit Binder: will include compiling and organizing all prevailing wage documentation, apprenticeship labor hour, and Domestic Content records required to sufficiently evidence that the requirements in the IRC have been met for the 30% base credit and 10% Domestic Content bonus credit.

Compass can offer flexible compliance support for your portfolio depending on which combination of base tax credit and bonus credits are pursued.

- Labor Provision Compliance

- Safeguard your full base credit value through compliance planning, implementation, and record keeping regarding prevailing wage and apprenticeship requirements.

- Labor Provision + Domestic Content Compliance

- Where you are looking to obtain the Domestic Content bonus credit in addition to the base tax credit; Safeguard your full base credit + bonus credit value through compliance planning, implementation, and record keeping regarding prevailing wage, apprenticeship, and Domestic Content requirements.

Compass is uniquely positioned to provide turn-key compliance, monitoring, and audit preparation due to our extensive experience with Domestic Content compliance, monitoring, and audit support from Ontario, Canada, which stipulated similar compliance requirements across supply chains.

Like the IRA requirements, the Ontario rules had both labour tracking and equipment manufacturer audit requirements. We completed Domestic Content auditing on over 200 MW of solar projects and as a result, developed a repeatable process that we can leverage to help assess compliance with the IRA requirements. We conducted over 50 manufacturing site audits throughout the solar supply chain in Ontario and are intimately familiar with the different major components and subcomponents that are used within each.

Compass Energy Consulting Relevant Experience

- Founded in 2011, Compass Energy Consulting has been providing regulatory and compliance support to the renewable energy industry throughout Canada and the Northeastern U.S. for over a decade.

- Over the last 6 years, Compass has supported Proponents in NYSERDA’s annual Tier 1 procurement, resulting in over 1GW of contract awards.

- This process of reviewing complex regulatory documents, establishing compliance requirements, and creating a compliance plan to implement, monitor, and record evidence is very much what we have done in other assignments, like the various Domestic Content Compliance engagements we have completed in the past.

NYSERDA’s Tier 1 RFP is known for its complex requirements, where our role is to review the RFP in detail and distill its requirements into discrete obligations for our clients providing strategic insight on exceeding the minimums.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—

Recap of NYSERDA’s 2021 Tier 1 Solicitation

NEW YORK’S LARGE SCALE RENEWABLES RFP

Highlights

- Annual Procurement Targets: in 2021, NYSERDA procured the greatest number of RECs in a given year, at 4.5 million Tier 1 RECs;

- Contract Attrition: About 14% of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects;

- Bid prices: Bid prices have come down from 2017 to 2020. Additionally, we see lower bid prices associated with larger projects, likely due to economies of scale. Bid prices from the 2021 solicitation have not yet been made public;

- Bid Price Structure: Since the introduction of the Index REC price structure in 2020, all awarded contracts have employed the Index REC. Currently only 5% of contracts awarded up to 2020 employ the Fixed REC price structure;

- Increase and Addition of Minimum Threshold Requirements: Interconnection and Permitting Viability categories saw an increase in the minimum requirements in 2021, while Energy Deliverability and Peak Coincidence categories were added; and

- Economic Benefits Priorities: A third category was introduced, Investments/Commitments to Local Economic and Workforce Development, and economic benefits that could be directed, in whole or in part, to Disadvantaged Communities would continue to be prioritized.

Introduction

New York State Energy Research and Development Authority (“NYSERDA”) has procured large scale renewables through the Renewable Energy Standard Tier 1 program since 2017. The 5th annual Tier 1 procurement in 2021 resulted in awards for twenty-two solar projects, including six with energy storage, to develop 2,408 megawatts (“MW”) of new, renewable energy capacity throughout New York State. The awarded contracts support the development of 159 megawatts, or nearly 600 megawatt-hours (“MWh”), of utility-scale energy storage.

Annual Procurement Targets & Timelines

The 2021 Tier 1 procurement target was drastically increased from previous years. Taking into account existing renewable energy generation, the White Paper on Clean Energy Standard Procurements to Implement New York’s Climate Leadership and Community Protection Act (2020 White Paper) indicated that statewide procurement totals will need to average almost 4,500 GWh annually over 2021 to 2026 period in order to meet the 2030 target of offsetting 70% of statewide electricity with non-emitting renewables (“70 by 30 Target”). The 2021 Tier 1 procurement target of approximately 4.5 million Tier 1 eligible Renewable Energy Certificates (“RECs”, measured in MWh) is three times higher, on average, than the previous years’ targets. The 2020 White Paper assumes a 20% contract attrition rate for this procurement forecast.

Tier 1 Program – New Renewables

The Renewable Energy Standard Tier 1 program is aimed at increasing new renewable energy development in New York State. Eligible Tier 1 resources include generators of electricity through the use of the following technologies: solar thermal, solar PV, on-land and offshore wind, hydroelectric, geothermal electric, geothermal ground source heat, tidal energy, wave energy, ocean thermal, and fuel cells which do not utilize a fossil fuel resource in the process of generating electricity, that entered commercial operation on or after January 1, 2015.

NYSERDA successfully procured 100% of the annual target and the greatest number of RECs in a given year to date. NYSERDA was able to realign to the expected RFP schedule of late-April release, late-June Step One deadline, and late-August Step Two submission deadline. Contract awards were announced in June 2022, which was later than expected.

Bid Price Structures

The 2021 Tier 1 procurement bid prices have not yet been made publicly available for the twenty-two projects awarded contracts. However, it is expected that all awarded bid proposals will employ the Index REC bid price structure, as seen in the previous year’s procurement. Currently, only four Tier 1 projects with active contracts from 2017 to 2020 remain under the Fixed REC price structure, or 5%.

The Index REC price structure offers a variable monthly payment depending on the reference energy and reference capacity prices calculated for that month. The Proponent bids a fixed strike price that gets adjusted by the Index REC price formula over the Contract Term.

| Year | Procurement Target (Tier 1 RECs) | Awarded Contracts (Tier 1 RECs) | Percentage of Target Awarded |

| 2017 | 1.5 million | 3.9 million | 260% |

| 2018 | 1.5 million | 3.9 million | 260% |

| 2019 | 1.5 million | 2.6 million | 170% |

| 2020 | 1.6 million | 4.1 million | 260% |

Bid Price Trends

The 2021 Tier 1 procurement bid prices have not yet been made publicly available for the twenty-two projects awarded contracts. However, it is expected that they will be made available in Q2/Q3 2023.

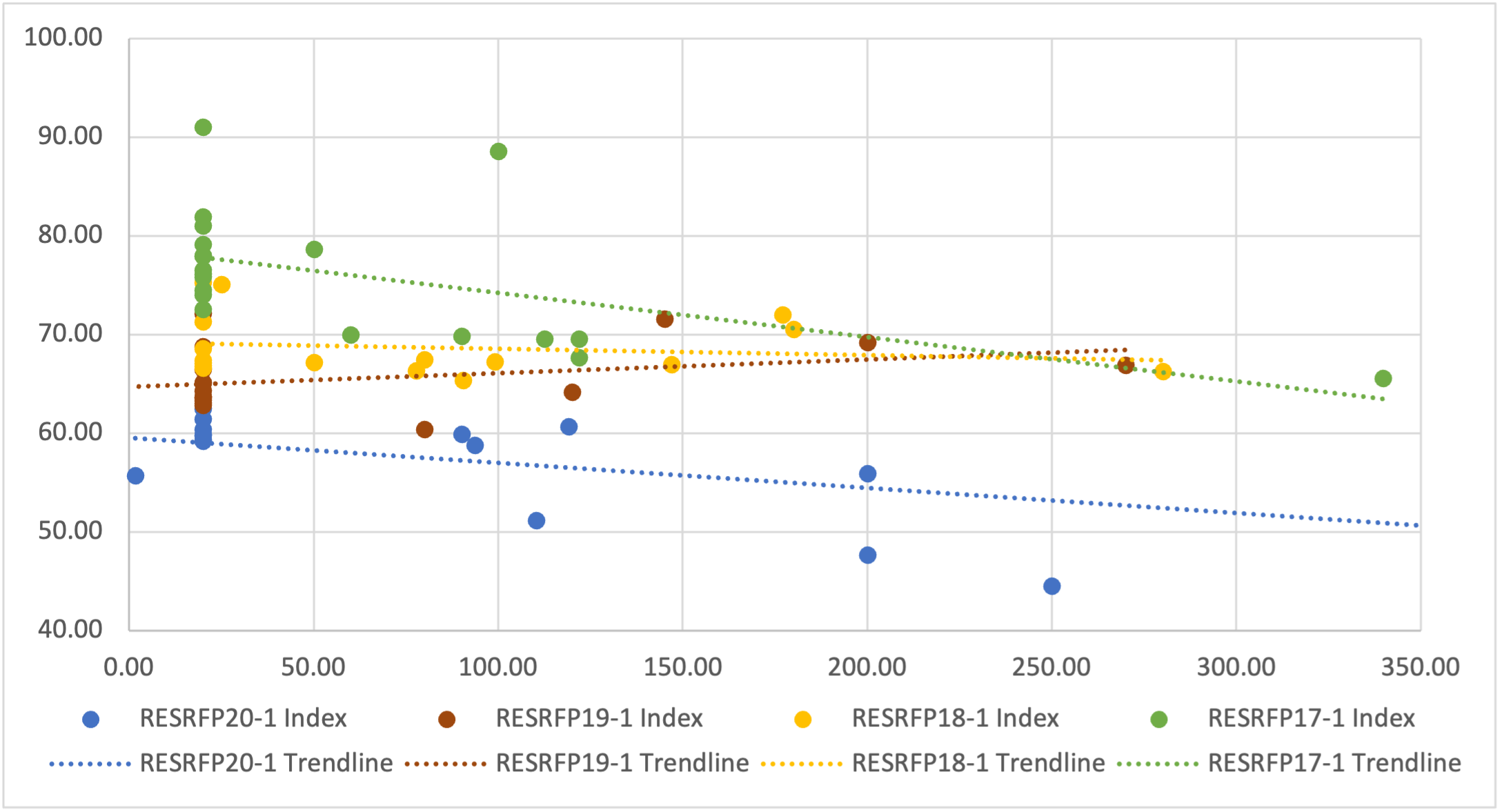

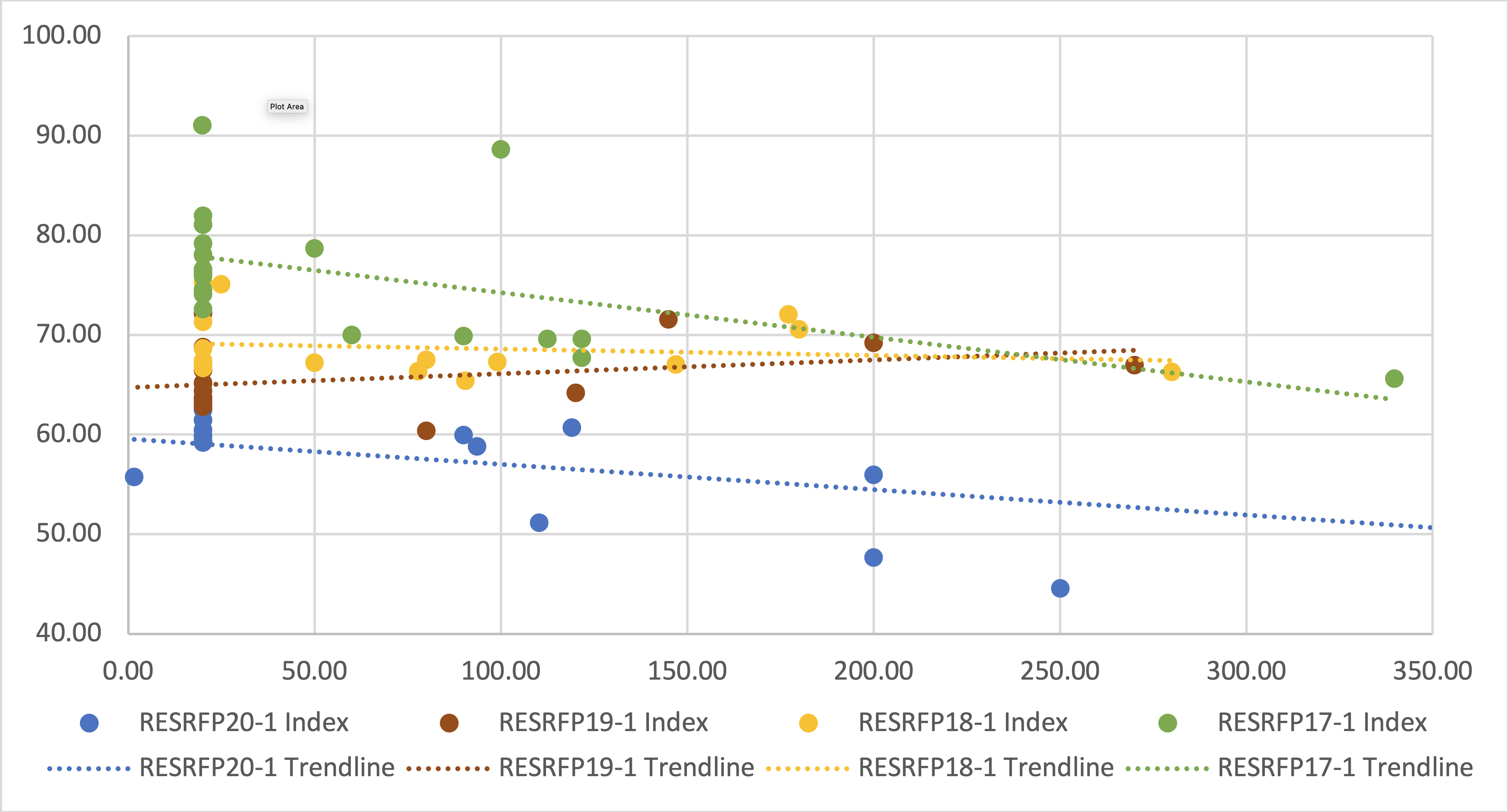

The chart below displays the Index REC pricing by procurement year from 2017 to 2020. As expected with economies of scale, we tend to see an inverse relationship between bid price and project size (MW), where the bid price decreases as the project size increases. A popular project size of 19.99 MW is noted across the four procurements, as this project size minimizes the bid fee (20 MW threshold) and environmental permitting obligations (25 MW threshold), while maintaining adequate economies of scale. Currently almost 50% of contracted projects are 19.99 MW or less in size.

Of the publicly available bid prices posted, we can see that pricing has decreased year over year from 2017 to 2020. About 75% of the bid proposals received in 2020 were submitted with Index REC bid prices (strike prices) below the lowest value from the year prior (2019). It is noted that of the canceled 2020 projects, three do not have publicly available bid prices, which indicates that a contract was never executed, and the other three have the lowest bid prices of the contracted projects in 2020, indicating perhaps that the bid price was not sufficient to successfully develop the project.

| Year | Average Size (MW) | Index REC Bid Price ($/MWh) | ||

| Average | Lowest | Highest | ||

| 2017 | 58 | 75.95 | 65.62 | 91.09 |

| 2018 | 83 | 68.72 | 65.39 | 75.32 |

| 2019 | 61 | 65.58 | 60.40 | 72.19 |

| 2020 | 96 | 56.85 | 44.55 | 62.50 |

Contract Attrition

NYSERDA has seen a significant amount of attrition in awarded Tier 1 projects. Procurements in 2017, 2018, and 2020 saw 50%-60% attrition of those years’ procurement targets. The current contract attrition rate from 2017 to 2021 dropped to 14% with the addition of the newly awarded contracts in 2021. However, it is too early to tell what percentage of 2021 contracts may be cancelled.

To date, 14% of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects.

Continuing NYSERDA’s efforts to pre-emptively screen for unviable projects, NYSERDA once again increased certain Minimum Threshold Requirements, which would ultimately prevent an immature or unproven project from receiving a contract award. Further to this, in 2021, NYSERDA introduced the Non-Viability Determination, which would authorize the Technical Evaluation Panel (“TEP”) to reject a Bid Proposal based upon a unanimous determination by the TEP that the project is not presently viable. Reasons for a determination of non-viability may include:

Technical Evaluation Panel (TEP) – Members of NYSERDA Staff, New York State Department of Public Service Staff, and competitively-selected Independent Evaluators responsible for evaluating Bid Proposals received through this RFP.

- The Bid Proposal is immature to such an extent that it would be impossible to ascertain whether it is viable;

- The Bid Proposal is predicated on unrealistic economic or regulatory assumptions; or

- The Bid Proposal is subject to serious economic or regulatory risks without a sufficient mitigation plan.

As noted in the 2020 White Paper, a project that offers a very low, perhaps an unrealistically low REC price could score well enough on the price criterion to be selected, despite receiving the lowest possible score on the project viability criterion. Selecting such projects for award would have a high likelihood for contract attrition and could jeopardize NYSERDA’s 70 by 30 Target. It is the intention of the Non-Viability Determination to avoid this situation.

Adjustments to the Scoring Matrix

The 2020 White Paper recommended that the Project Viability category and Operational Flexibility and Peak Coincidence category, each worth 10%, be combined into a single category worth 20% of the total score. The reason for the proposed change is that considerations in the Operational Flexibility and Peak Coincidence category will be increasingly intertwined with Project Viability as the penetration of renewable energy increases. Projects that are operationally flexible (dispatchable) and peak coincident will also be those most likely to avoid curtailment, local reliability constraints, and burdensome interconnection requirements. Consolidating these categories will allow evaluators to better reward projects that are truly exceptional across these metrics. The 2021 Tier 1 procurement incorporated this adjustment to the scoring matrix.

| Item | Points |

| Bid Price | 70 |

| Project Viability, Operational Flexibility & Peak Coincidence | 20 |

| Economic Benefits to NYS | 10 |

| Total | 100 |

Increase in Minimum Threshold Requirements

In 2021, the Minimum Threshold Requirements were updated across two of the Project Viability categories: Interconnection and Permitting. Two additional categories were added: Energy Deliverability and Peak Coincidence.

The Interconnection Minimum Threshold Requirement appears to have been maintained at NYISO Interconnection Stage 5, that a System Reliability Impact Study (“SRIS”) or System Impact Study (“SIS”) is in progress, however the required minimum evidence was updated to include evidence of deposit and fees paid to commence the SRIS/SIS.

With the updated scoring matrix, which combines the Operational Flexibility and Peak Coincidence categories within the Project Viability categories, Energy Deliverability became a new Minimum Threshold Requirement category.

NYISO Interconnection Status Key

1=Scoping Meeting Pending, 2=FES Pending, 3=FES in Progress, 4=SRIS/SIS Pending, 5=SRIS/SIS in Progress, 6=SRIS/SIS Approved, 7=FS Pending, 8=Rejected Cost Allocation/Next FS Pending, 9=FS in Progress, 10=Accepted Cost Allocation/IA in Progress, 11=IA Completed, 12=Under Construction, 13=In Service for Test, 14=In Service Commercial, 0=Withdrawn

In the previous procurement the Proposer had the opportunity to score points by “demonstrating with currently available knowledge, that their proposed point of delivery into the NYCA, along with their proposed interconnection and transmission and/or distribution upgrades, is sufficient to ensure full energy dispatch of the Bid Facility’s expected generation output.” (RESRFP20-1) In 2021, the scoring opportunity was maintained with an increased focus on the importance of “the benefits afforded to the electric grid in light of the CES goals to expand the share of renewable energy as a portion of total energy consumed in New York State to 70 percent by the year 2030 (“70 by 30 Target”), including benefits to address grid congestion and delivery constraints, and the extent to which a Proposer can demonstrate that the Bid Facility can deliver firm power (e.g., Bid Quantity as proposed to NYSERDA) to the electrical system without adversely impacting the generation output profile of both existing and planned renewable generators.” (RESRFP21-1)

In addition to the robust Permitting Plan requirement introduced in the previous solicitation, the Permitting Minimum Threshold Requirement increased in 2021 to require a minimum level of permitting studies based on the expected permitting process of the proposed Bid Facility. Bid Facilities proceeding through the Office of Renewable Energy Siting (“ORES”) must provide evidence that the following studies have been completed: 1) Wildlife Characterization Report, 2) Draft Desktop Wetlands and Water Resources Delineation, and 3) Phase IA Archeological Desktop Survey.

Peak Coincidence was also named as a new Minimum Threshold category in 2021, however the inputs required by a Proposer are quite minimal and appear to be covered by the Interconnection and Energy Deliverability categories. In this category, NYSERDA will evaluate how closely the Bid Facility’s expected generation profile matches future estimates of NYISO load, and how the Bid Facility completements other renewable generation already under contract to New York State.

We’ve detailed the top mistakes to avoid when preparing a bid submission for a Renewable Energy RFP. Feel free to take a read of our blog post “Avoid These 3 Common Mistakes in Your Energy Procurement Bid Submission” for more information and how to lead to a successful bid strategy.

Incremental Economic Benefits to New York State

Incremental Economic Benefits to New York State, representing 1/3rd of the 30 non-price points, ranks bid submissions on the extent of eligible expenditures committed to. Eligibility begins from RFP Release Date through the life of the contract. NYSERDA continued their prioritization of Disadvantaged Communities and stated that “NYSERDA will more favorably evaluate economic benefits to New York State that will be realized in part or in full by Disadvantaged Communities as part of the proposed projects’ development.” New York’s Climate Act recognizes that climate change does not affect all communities equally. The Climate Act charged the Climate Justice Working Group (“CJWG”) with the development of criteria to identify disadvantaged communities to ensure that frontline and otherwise underserved communities benefit from the state’s historic transition to cleaner, greener sources of energy, reduced pollution and cleaner air, and economic opportunities. NYSERDA offers a map tool online, which can help to identify Disadvantaged Communities.

NYSERDA introduced a third category of economic benefits, Investments/Commitments to Local Economic and Workforce Development. This category is evaluated based on firmness, credibility, and maturity of the commitments. Commitments under this category include apprenticeships, internships, training, etc. Proposers are encouraged to work with the host community or Authority Having Jurisdiction (AHJ) to determine if there are economic benefit opportunities that could be uniquely afforded to one or more local organizations or groups.

Economic Benefits in category 1 (long-term) and category 2 (short-term) committed to, up to Contract Year 3, form part of the contract and as such must be verified by an independent certified public accountant (“CPA”). If the Economic Benefits Report evaluated by the independent CPA cannot verify that at least 85% of the committed spending occurred in NYS and as stated, then NYSERDA has the right to adjust the monthly REC price payable for the remainder of the contract term by a percentage equal to the deficit noted in through the verification process. Due to the above, Economic Benefits that occur prior to the end of Contract Year 3 are prioritized over commitments that may occur further in the future.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—

Avoid These 3 Common Mistakes in Your Energy Procurement Bid Submission

As a developer of renewable energy projects, you are aware of the importance of a high-quality bid submission. At a time when state and federal governments are setting massive renewable goals, and seeking large-scale projects to help meet that demand, responding to Request For Proposals (RFPs) is, now more than ever, an essential part of large-scale Renewable Energy development. RFPs are an essential tool to collect, evaluate, and determine the most competitive solutions.

1. Price vs. Non-Price Components

Bid price is often the heaviest weighted component of a bid submission in energy procurements. It is essential to governments to get the most competitive rates for additional energy supply on behalf of their rate payers. However, bid price alone cannot win a contract. Typically, procurements include non-price components that are a mix of mandatory requirements and rated criteria. It is critical to your submission to ensure that the mandatory requirements are met, and the rated criteria are strategically fulfilled to maximize scoring. Strategically approaching the rated criteria is your opportunity to differentiate your bid submission and add credibility to your development team. The non-price components are where you can highlight your experience and capability in renewable energy development, which support your claims for successful and timely development of your project.

2. Long Lead Time Deliverables

Without fail, there will be an aspect of the procurement which requires early engagement in order to deliver a final product prior to the bid deadline. Whether it is advanced progress in interconnection, permitting, site control, or other, your success will be tied to how well you can meet and exceed the requirements of the procurement. Without a central bid manager, long lead time items may be missed until it is too late to act. In addition, missing the early engagement in a procurement is doing a disservice to your development team. Typically, there will be a deadline for questions, after which your review and identification of inconsistencies or confusion in the procurement document may not be received. The Q&A period is your opportunity to request clarification and highlight amendments that could benefit your projects.

3. Dedicated Resource

Large-scale renewable energy development requires significant input from multiple people within the development team. Without a dedicated resource acting as the central bid manager, the multiple moving parts of the bid submission will not be compiled smoothly and might lead to discrepancies from one section to another. A central bid manager is beneficial in identifying information gaps and opportunities. It is critical that a dedicated resource owns the bid development and submission process.

Your development team has sunken a significant development cost into your project by the time a bid submission is made. You’ve secured land contracts, conducted interconnection screening, budget analysis, resource assessment, preliminary engineering… not to mention internal time and resources. Depending on the size of the RFP, you are likely spending over $100,000 on internal and external costs to create your bid response. As an organization that has invested a considerable amount of time and money into the initial development of your project, you want to ensure that you’re putting your best foot forward. Having a dedicated person who understands the intricate RFP requirements, performs quality control reviews on submission documents, and ensures the timely submission of your response is critical for a successful RFP submission.

Compass can lead the way to a successful bid submission by being a central point of contact and a source of information and strategic advice to ensure all requirements are met and exceeded. If you’d like support on your next RFP, please feel free to reach out directly to myself:

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

Recap of NYSERDA’s 2020 Tier 1 Solicitation

NEW YORK’S LARGE SCALE RENEWABLES RFP

Highlights

- Annual Procurement Targets: From 2017 to 2020, NYSERDA has procured on average 250% of their annual procurement targets;

- Contract Attrition: About 1/5th of awarded contracts over the 2017 to 2020 time period have been canceled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects;

- Bid prices: Bid prices have come down from 2017 to 2020. Additionally, we see lower bid prices associated with larger projects, likely due to economies of scale;

- Bid Price Structure: Since the introduction of the Index REC price structure in 2020, all awarded contracts have employed the Index REC. Currently, only 5% of contracts awarded up to 2020 employ the Fixed REC price structure;

- Increase and Addition of Minimum Threshold Requirements: Interconnection, Permitting, and Financing Project Viability categories all saw an increase in the minimum requirements in 2020, in an attempt to weed out non-viable projects and reduce contract attrition. A new category, Embodied Carbon and Carbon Emissions, was added; and

- Economic Benefits Priorities: The concept of Disadvantaged Communities was introduced, where economic benefits that could be direct in whole or in part to these communities would be prioritized.

New York State Energy Research and Development Authority (“NYSERDA”) has procured large-scale renewables through the Renewable Energy Standard Tier 1 program since 2017. The 4th annual Tier 1 procurement in 2020 resulted in awards for twenty-one solar projects, including three with energy storage, and one hydroelectric facility, to develop 2,111 megawatts (“MW”) of new, renewable energy capacity throughout New York State. The awarded contracts support the development of 30 megawatts, or 120 megawatt-hours (“MWh”), of utility-scale energy storage.

Annual Procurement Targets & Timelines

The 2020 Tier 1 procurement target was approximately 1.6 million Tier 1 eligible Renewable Energy Certificates (“RECs”), up slightly from the previous year’s targets. NYSERDA procured three times their 2020 target, which was a similar case for the previous three Tier 1 procurements.

| Year | Procurement Target (Tier 1 RECs) | Awarded Contracts (Tier 1 RECs) | Percentage of Target Awarded |

| 2017 | 1.5 million | 3.9 million | 260% |

| 2018 | 1.5 million | 3.9 million | 260% |

| 2019 | 1.5 million | 2.6 million | 170% |

| 2020 | 1.6 million | 4.1 million | 260% |

Tier 1 Program – New Renewables

The Renewable Energy Standard Tier 1 program is aimed at increasing new renewable energy development in New York State. Eligible Tier 1 resources include generators of electricity through the use of the following technologies: solar thermal, solar PV, on-land and offshore wind, hydroelectric, geothermal electric, geothermal ground source heat, tidal energy, wave energy, ocean thermal, and fuel cells which do not utilize a fossil fuel resource in the process of generating electricity, that entered commercial operation on or after January 1, 2015.

Due to delays mainly caused by COVID-19, the typical timeline for the issuance of the Tier 1 procurement was pushed back from late April to late July 2020, causing about a 3-month delay. NYSERDA surveyed developers to understand whether or not delaying the procurement further would be helpful or harmful. Bid packages were ultimately submitted in late October 2020. This initial delay led to further delays in the review of bid packages and contract award notifications and ultimately caused contract negotiations to bleed into 2021.

Bid Price Structures

Introduction of the Index REC Price Structure

The Tier 1 procurements were amended on January 16, 2020 by the Order Modifying Tier 1 Renewable Procurements, whereby the Public Service Commission (“PSC”) directed NYSERDA to offer bidders an Index REC price option in future RES solicitations, beginning with RESRFP20-1.

The 2020 Tier 1 procurement saw the introduction of the Index REC price structure. The Index REC price structure offers a variable monthly payment depending on the reference energy and reference capacity prices calculated for that month. The Proponent bids a fixed strike price that gets adjusted by the Index REC price formula over the Contract Term. While NYSERDA still allows Proponent’s to bid a Fixed REC, since the introduction of the Index REC price structure, all contracted projects have been Index REC proposals. In early 2021, previously contracted projects with a Fixed REC price structure were offered an opportunity to convert to an Index REC price structure. Currently, only four Tier 1 projects with active contracts from 2017 to 2020 remain under the Fixed REC price structure, or 5%.

Bid Price Trends

The chart below displays the Index REC pricing by procurement year from 2017 to 2020. As expected with economies of scale, we tend to see an inverse relationship between bid price and project size (MW), where the bid price decreases as the project size increases. A popular project size of 19.99 MW is noted across the four procurements, as this project size minimizes the bid fee (20 MW threshold) and environmental permitting obligations (25 MW threshold), while maintaining adequate economies of scale. Currently almost 50% of contracted projects are 19.99 MW or less in size.

Of the publicly available bid prices posted, we can see that pricing has decreased year over year from 2017 to 2020. About 75% of the bid proposals received in 2020 were submitted with Index REC bid prices (strike prices) below the lowest value from the year prior (2019). It is noted that of the canceled 2020 projects, three do not have publicly available bid prices, which indicates that a contract was never executed, and the other three have the lowest bid prices of the contracted projects in 2020, indicating perhaps that the bid price was not sufficient to successfully develop the project.

| Year | Average Size (MW) | Index REC Bid Price ($/MWh) | ||

| Average | Lowest | Highest | ||

| 2017 | 58 | 75.95 | 65.62 | 91.09 |

| 2018 | 83 | 68.72 | 65.39 | 75.32 |

| 2019 | 61 | 65.58 | 60.40 | 72.19 |

| 2020 | 96 | 56.85 | 44.55 | 62.50 |

Contract Attrition

NYSERDA has seen a significant amount of attrition in awarded Tier 1 projects. Procurements in 2017, 2018, and 2020 saw 50%-60% attrition of those years’ procurement targets. However, due to the substantial over-procurement across those years, this translates to just under 20% contract attrition from 2017 to 2020. Included in the canceled 2020 contracts, was 20 MW of energy storage or 80 MWh of storage capacity.

About 1/5th of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects.

In an effort to pre-emptively screen for unviable projects, NYSERDA began their trend of increasing certain Minimum Threshold Requirements, which would ultimately prevent an immature or unproven project from receiving a contract award.

Increase in Minimum Threshold Requirements

In 2020, the Minimum Threshold Requirements were increased across three of the Project Viability categories: Interconnection, Permitting, and Financing.

The Interconnection Minimum Threshold Requirement increased from simply having submitted a valid interconnection request and providing evidence of initial fee payment, to requiring that a System Reliability Impact Study (“SRIS”) or System Impact Study (“SIS”) is in progress. In terms of New York Interconnection System Operator’s (“NYISO”) interconnection status key, that is an increase from Stage 1 all the way to Stage 5. This drastic escalation in minimum required interconnection progress set the bar high and eliminated immature projects from being eligible to submit in the 2020 Tier 1 procurement.

NYISO Interconnection Status Key

1=Scoping Meeting Pending, 2=FES Pending, 3=FES in Progress, 4=SRIS/SIS Pending, 5=SRIS/SIS in Progress, 6=SRIS/SIS Approved, 7=FS Pending, 8=Rejected Cost Allocation/Next FS Pending, 9=FS in Progress, 10=Accepted Cost Allocation/IA in Progress, 11=IA Completed, 12=Under Construction, 13=In Service for Test, 14=In Service Commercial, 0=Withdrawn

The Permitting Minimum Threshold Requirement increased in 2020 to require a robust Permitting Plan document following NYSERDA’s detailed guidance provided in an appendix. The guidance document details a hierarchal mitigation approach as well as the potential requirement to make mitigation payments where projects overlapped with Mineral Soil Groups 1-4. The Permitting Plan must demonstrate a full understanding of the potential environmental and agricultural impacts of the project and feasible plans to mitigate such impacts.

The Project Development Minimum Threshold Requirement category was expanded to include Project Financing and Proposer Creditworthiness. A requirement for a detailed financing plan, that demonstrates the financial capability to complete construction by the proposed commercial operation date was added. Organizational charts, management charts, and audited financial statements are a few of the required attachments to the newly required financial plan.

The 2020 Tier 1 procurement introduced a new Project Viability category, which added another Minimum Threshold Requirement to the bid submissions. The Carbon Emissions and Embodied Carbon category required Proposers to describe efforts that have or can be undertaken to minimize the project’s embodied carbon intensity, as well as provide an explanation of any available process to account for embodied carbon on an ongoing basis through development, construction, and operation of the project.

We’ve detailed the top mistakes to avoid when preparing a bid submission for a Renewable Energy RFP. Feel free to take a read of our blog post “Avoid These 3 Common Mistakes in Your Energy Procurement Bid Submission” for more information and how to lead to a successful bid strategy.

Incremental Economic Benefits to New York State

Incremental Economic Benefits to New York State, representing 1/3rd of the 30 non-price points, ranks bid submissions on the extent of eligible expenditures committed to, eligibility begins from RFP Release Date through the life of the contract. NYSERDA introduced the concept of a Disadvantaged Community and stated that “NYSERDA will more favorably evaluate economic benefits to New York State that will be realized in part or in full by Disadvantaged Communities as part of the proposed projects’ development.” New York’s Climate Act recognizes that climate change does not affect all communities equally.

| Item | Points |

| Bid Price | 70 |

| Project Viability Categories | 10 |

| Operational Flexibility / Peak Coincidence | 10 |

| Economic Benefits to NYS | 10 |

| Total | 100 |

The Climate Act charged the Climate Justice Working Group (“CJWG”) with the development of criteria to identify disadvantaged communities to ensure that frontline and otherwise underserved communities benefit from the state’s historic transition to cleaner, greener sources of energy, reduced pollution and cleaner air, and economic opportunities. NYSERDA offers a map tool online, which can help to identify Disadvantaged Communities.

Economic Benefits committed to, up to Contract Year 3, form part of the contract and as such must be verified by an independent certified public accountant (“CPA”). If the Economic Benefits Report evaluated by the independent CPA cannot verify that at least 85% of the committed spending occurred in NYS and as stated, then NYSERDA has the right to adjust the monthly REC price payable for the remainder of the contract term by a percentage equal to the deficit noted in through the verification process. Due to the above, Economic Benefits that occur prior to the end of Contract Year 3 are prioritized over commitments that may occur further in the future.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—

The True Costs Associated with Bidding on Renewable RFPs

At a time when state and federal governments are setting massive renewable goals, and seeking large-scale projects to help meet that demand, responding to Request For Proposals (RFPs) is now more than ever an essential part of large-scale Renewable Energy development.

DEADLINE APPROACHING! Prequalify for New York’s Energy Storage RFPs

Are you an energy developer who conducts business in New York? Then time is running out for you to submit your pre-qualification documents for the upcoming New York Battery Storage RFPs! Released by the independently operated utilities of New York State, projects range from 10 MW to 300 MW and are available to companies who have prior Energy Storage experience.

Top 5 Energy RFP Pitfalls

Whether it’s a public or private sector energy organization, many companies rely on Requests for Proposals (RFPs) to collect, evaluate, and determine the most competitive solution to ensure the success of their business and operations. A responding bidder is required to invest a large amount of time, effort and money into developing a submission to an RFP. In most cases, bidders must display some level of site control, at least have submitted an application for interconnection, and have completed at a minimum a desktop assessment of the natural and cultural heritage features on the project site and surrounding areas. By the time a bidder is prepared to respond to an RFP, they likely have already invested thousands of dollars into the initial development of the project, if not more. Increasingly, requirements for community outreach and engagement are being added to the RFP process, which adds additional effort for the bidder for community meetings, outreach, and to facilitate building the on-going relationship. There are any number of pitfalls that could cause your submission to be scored poorly or worse, terminated. Below are the top 5 RFP pitfalls that we’ve either helped our clients avoid or heard horror stories from clients’ previous experiences.