Making Sense of the Federal ITC Legislation

Author: Rachelle Lynne-Davies, P.Eng.

The first in a series of ITC blogs from Compass Energy Consulting

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon

The Clean Technology Investment Tax Credit (“Clean Tech ITC”) incentivizes the deployment of renewables and energy storage in Canada by offering an up-to 30% refundable tax credit for investments in eligible projects.

A 100MW wind farm in Saskatchewan, which has eligible capital costs of CAD $200 million and complies with the labour requirements, can expect to claim $60 million in refundable tax credits.

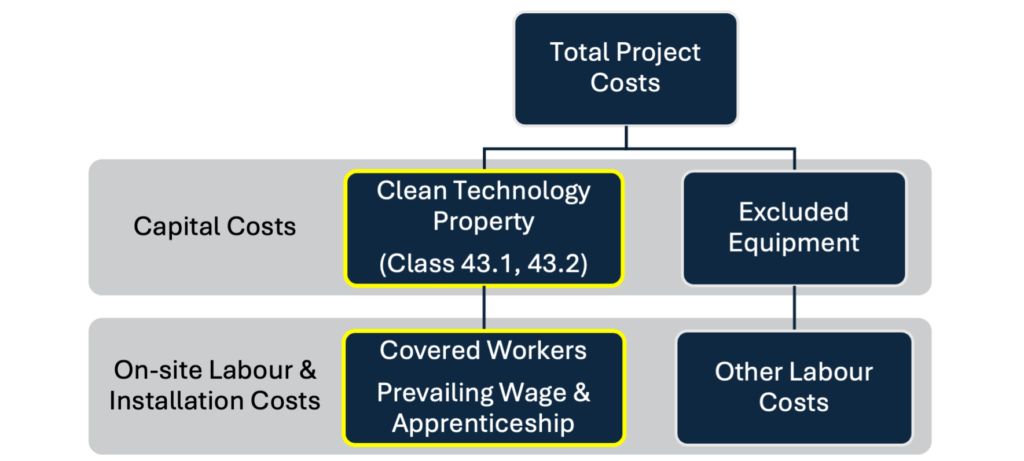

Figure 1. Breakdown of the Regular Tax Credit Rate

While the reduced tax credit rate (20%) is secured simply by incurring eligible capital cost of clean technology property, the added 10% requires compliance with the labour requirements.

With a significant amount of project capital costs on the line, it will be critical for project stakeholders, especially financers and lenders in addition to owners, EPCs, and contractors, to understand the mechanics of the Clean Tech ITC and to ensure labour compliance is met and can be evidenced.

Clean Technology Property

Clean Technology Property is identified as property described in Class 43.1 and 43.2 in Schedule II to the Income Tax Regulations. Nineteen categories of systems and equipment fall under the definition of Clean Technology Property as per specific subsections of Class 43.1 and 43.2. It is important to note that not all project capital costs for those systems are eligible properties. Meaning the 30% tax credit will not be applied to the entire cost of bringing your facility online, nor will all of the on-site labour be required to adhere to the prevailing wage and apprenticeship requirements. Understanding what components of your eligible project are covered and therefore what labour must comply is important in ensuring and facilitating compliance. See Figure below.

Figure 2. Breakdown of Total Project Costs

For starters, “Clean Technology Property” has to satisfy a few requirements:

- It has to be located in Canada;

- It has to be new equipment;

- If leased by the taxpayer, it must be leased to another person or partnership that are taxable Canadian corporations;

- It has to fall under one of the 19 categories of systems and equipment described in (d) of the definition, pointing back to Class 43.1 and 43.2, which includes:

- Equipment used to generate electricity from solar, wind, and water energy (<50MW);

- Stationary electricity storage equipment (including batteries, compressed air, and flywheels);

- Active solar heating equipment and air-source or ground-source heat pumps;

- Non-road zero-emission vehicles and charging or refuelling equipment;

- Equipment used exclusively to generate heat or electricity (or a combo) from geothermal energy;

- Concentrated solar energy equipment; and

- Small modular nuclear reactors.

There are specific equipment that are not included as Clean Technology Property, which are referred to as “excluded property”. These include:

- auxiliary heating or electrical generating equipment that uses any fossil fuel;

- buildings or structures other than those structures described in paragraph (i) of the definition of concentrated solar energy equipment;

- distribution equipment;

- property included in Class 10 in Schedule II to the Income Tax Regulations; and

- property that would be included in Class 17 in Schedule II to the Income Tax Regulations if that Class were read without reference

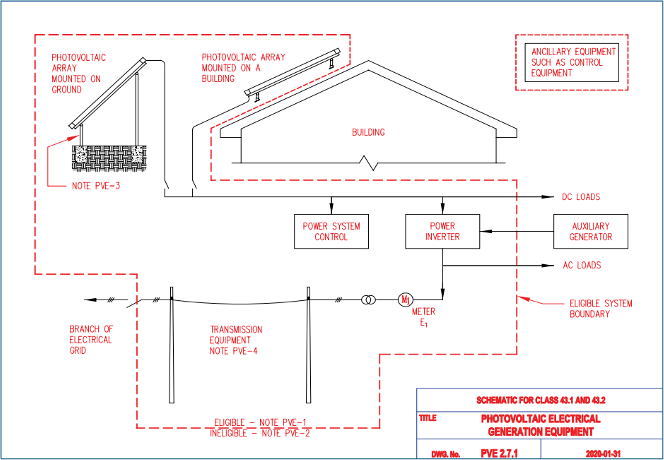

For example, a new-build ground-mounted solar project located in Canada that is used primarily for the purpose of generating electrical energy from solar energy falls under Class 43.1 (d)(vi) as “fixed location solar photovoltaic equipment”. The breakdown of capital costs per section 2.7 of the Technical Guide to Class 43.1 and 43.2 is in the table below.

Table 1. Eligible and Ineligible Properties for Photovoltaic Electrical Generating Equipment

| Eligible Properties | Ineligible Properties |

Purchase and installation of:

|

|

A typical configuration of solar cells or modules and related equipment that would qualify as photovoltaic equipment is shown in the schematic below.

Figure 3. Photovoltaic Electrical Generating Equipment Schematic

As per PV-4 in the technical guide, “Eligible transmission equipment is site specific and is dependent on the electrical grid configuration near the site. In general, it includes transmission lines (and related equipment) from the electrical energy generating equipment up to the interface with the electrical grid or the isolation switch of the local electrical utility, or up to the point where, on an annual basis, more than 75 percent of the electrical energy transmitted by the transmission equipment is electrical energy generated by the photovoltaic electrical generation equipment, whichever point comes first.”

Distribution equipment, which is considered excluded property, is defined in subsection 1104(13) of the Income Tax Regulations as “equipment (other than transmission equipment) used to distribute electrical energy generated by electrical generating equipment.”

On-site Labour and Installation

Since a subset of the total project capital costs are considered eligible property, only that corresponding subset of on-site labour and installation is included in the Clean Tech ITC, however it must comply with the labour requirements to be eligible for the regular tax credit rate.

The federal legislation defines “covered worker” as an individual who is engaged in the preparation or installation of specified property at a designated worksite, whose work duties are primarily manual or physical in nature, and who is not administrative, clerical, an executive employee, or a business visitor to Canada. Specified Property in this definition (127.46) is equivalent to the definition of Clean Tech Property (127.45).

Since covered workers must be paid the prevailing wage for their work on-site for the preparation or installation of specified property, it is extremely important to understand the difference between eligible properties and ineligible properties based on the specific type of renewable energy facility that falls under the definition of Clean Technology Property as per Class 43.1 and 43.2.

Additionally, there are apprenticeship requirements which necessitate the tracking of labour hours performed by Red Seal workers to ensure that at least 10% of those total hours are worked by apprentices registered in a Red Seal trade. This level of compliance monitoring will add a layer of due diligence that would otherwise not be required. It is imperative to have a solid foundation of the mechanics of the Clean Tech ITC and labour requirements before engaging your supply chain and executing contractual documents.

Clean Technology ITC Decreases Over Time

The specified percentage of the Clean Tech ITC begins at 30% and steps down after a decade to 15% and then zero after December 31, 2034. See Table below.

Table 2. Clean Technology ITC Specified Percentage Over Time

| Date | Specified Percentage |

| After Mar 28, 2023 and before Jan 1, 2034 | 30% |

| After Dec 31, 2033 and before Jan 1, 2035 | 15% |

| After Dec 31, 2034 | 0% |

The Need for Compliance Management Support

It would be detrimental to project stakeholders to misinterpret the eligible and ineligible properties that are defined as Clean Tech Property (or specified property), as it could lead to additional project costs for prevailing wages that are not required, and perhaps more importantly, it could artificially inflate the total Clean Tech ITC that the taxpayer is relying on. Not only would you be including ineligible properties in the capital cost calculation, but you may be paying a premium for the labour and installation of those ineligible properties, all of which is not claimable under the Clean Tech ITC.

The labour and apprenticeship requirements give rise to the need for compliance planning, monitoring, and data management of evidence.

Why Compass Energy Consulting?

Founded in 2011, Compass has been providing regulatory and compliance support to the renewable energy marketplace throughout Canada and the Northeastern U.S. for many years. Our team of consultants have helped to design some of the largest Domestic Content compliance obligations for renewable energy procurements, like those found in Ontario’s Feed-in Tariff program, and helped developers participate and win in some of the largest procurements, like NYSERDA’s Tier 1 REC RFP.

Compass is uniquely positioned to provide a turn-key compliance, monitoring, and audit service due to our experience providing these types of services to over 200 MW of projects under Ontario’s Feed-in Tariff 1 and 2 Domestic Content compliance regime. Our compliance assessments were provided for project owners but importantly were relied upon by project lenders to ensure projects satisfied this critical and binary contractual obligation.

Compass Energy Consulting is your insurance policy for your ITC. Feel free to reach out to me at rachelle@compassenergyconsulting.ca to discuss further.

Check Out The Next Blog in the ITC Series

| Definitions

clean technology property means property a) situated in Canada (including property described in subparagraph (d)(v) or (xiv) of Class 43.1 in Schedule II to the Income Tax Regulations that is installed in the exclusive economic zone of Canada) and intended for use exclusively in Canada; b) that has not been used, or acquired for use or lease, for any purpose whatever before it was acquired by the taxpayer; c) that, if it is to be leased by the taxpayer to another person or partnership, is i. leased to a qualifying taxpayer or a partnership all the members of which are taxable Canadian corporations, and ii. leased in the ordinary course of carrying on a business in Canada by the taxpayer whose principal business is selling or servicing property of that type, or whose principal business is leasing property, lending money, purchasing conditional sales contracts, accounts receivable, bills of sale, chattel mortgages or hypothecary claims on movables, bills of exchange or other obligations representing all or part of the sale price of merchandise or services, or any combination thereof; and d) that is i. equipment used to generate electricity from solar, wind and water energy that is described in subparagraph (d)(ii), (iii.1), (v), (vi) or (xiv) of Class 43.1 in Schedule II to the Income Tax Regulations, ii. stationary electricity storage equipment that is described in subparagraph (d)(xviii) or (xix) of Class 43.1 in Schedule II to the Income Tax Regulations, but excluding equipment that uses any fossil fuel in operation, iii. active solar heating equipment, air-source heat pumps and ground-source heat pumps that are described in subparagraph (d)(i) of Class 43.1 in Schedule II to the Income Tax Regulations, iv. a non-road zero-emission vehicle described in Class 56 in Schedule II to the Income Tax Regulations and charging or refuelling equipment described in subparagraph (d)(xxi) of Class 43.1 in Schedule II to the Income Tax Regulations or subparagraph (b)(ii) of Class 43.2 in Schedule II to the Income Tax Regulations that in each case is used primarily for such vehicles, v. equipment used exclusively for the purpose of generating electrical energy or heat energy, or a combination of electrical energy and heat energy, solely from geothermal energy, that is described in subparagraph (d)(vii) of Class 43.1 in Schedule II to the Income Tax Regulations, but excluding any equipment that is part of a system that extracts fossil fuel for sale, vi. concentrated solar energy equipment, or vii. a small modular nuclear reactor. covered worker means an individual (other than a trust) a) who is engaged in the preparation or installation of specified property at a designated work site as an employee of an incentive claimant or of another person or partnership; b) whose work or duties in respect of the designated work site are primarily manual or physical in nature; and c) who is not i. an administrative, clerical or executive employee, or ii. a business visitor to Canada as described in section 187 of the Immigration and Refugee Protection Regulations. reduced tax credit rate means the regular tax credit rate minus 10 percentage points. regular tax credit rate means the specified percentage (as defined in subsections 127.44(1) and 127.45(1), as the case may be). |