Recap of NYSERDA’s 2021 Tier 1 Solicitation

NEW YORK’S LARGE SCALE RENEWABLES RFP

Highlights

- Annual Procurement Targets: in 2021, NYSERDA procured the greatest number of RECs in a given year, at 4.5 million Tier 1 RECs;

- Contract Attrition: About 14% of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects;

- Bid prices: Bid prices have come down from 2017 to 2020. Additionally, we see lower bid prices associated with larger projects, likely due to economies of scale. Bid prices from the 2021 solicitation have not yet been made public;

- Bid Price Structure: Since the introduction of the Index REC price structure in 2020, all awarded contracts have employed the Index REC. Currently only 5% of contracts awarded up to 2020 employ the Fixed REC price structure;

- Increase and Addition of Minimum Threshold Requirements: Interconnection and Permitting Viability categories saw an increase in the minimum requirements in 2021, while Energy Deliverability and Peak Coincidence categories were added; and

- Economic Benefits Priorities: A third category was introduced, Investments/Commitments to Local Economic and Workforce Development, and economic benefits that could be directed, in whole or in part, to Disadvantaged Communities would continue to be prioritized.

Introduction

New York State Energy Research and Development Authority (“NYSERDA”) has procured large scale renewables through the Renewable Energy Standard Tier 1 program since 2017. The 5th annual Tier 1 procurement in 2021 resulted in awards for twenty-two solar projects, including six with energy storage, to develop 2,408 megawatts (“MW”) of new, renewable energy capacity throughout New York State. The awarded contracts support the development of 159 megawatts, or nearly 600 megawatt-hours (“MWh”), of utility-scale energy storage.

Annual Procurement Targets & Timelines

The 2021 Tier 1 procurement target was drastically increased from previous years. Taking into account existing renewable energy generation, the White Paper on Clean Energy Standard Procurements to Implement New York’s Climate Leadership and Community Protection Act (2020 White Paper) indicated that statewide procurement totals will need to average almost 4,500 GWh annually over 2021 to 2026 period in order to meet the 2030 target of offsetting 70% of statewide electricity with non-emitting renewables (“70 by 30 Target”). The 2021 Tier 1 procurement target of approximately 4.5 million Tier 1 eligible Renewable Energy Certificates (“RECs”, measured in MWh) is three times higher, on average, than the previous years’ targets. The 2020 White Paper assumes a 20% contract attrition rate for this procurement forecast.

Tier 1 Program – New Renewables

The Renewable Energy Standard Tier 1 program is aimed at increasing new renewable energy development in New York State. Eligible Tier 1 resources include generators of electricity through the use of the following technologies: solar thermal, solar PV, on-land and offshore wind, hydroelectric, geothermal electric, geothermal ground source heat, tidal energy, wave energy, ocean thermal, and fuel cells which do not utilize a fossil fuel resource in the process of generating electricity, that entered commercial operation on or after January 1, 2015.

NYSERDA successfully procured 100% of the annual target and the greatest number of RECs in a given year to date. NYSERDA was able to realign to the expected RFP schedule of late-April release, late-June Step One deadline, and late-August Step Two submission deadline. Contract awards were announced in June 2022, which was later than expected.

Bid Price Structures

The 2021 Tier 1 procurement bid prices have not yet been made publicly available for the twenty-two projects awarded contracts. However, it is expected that all awarded bid proposals will employ the Index REC bid price structure, as seen in the previous year’s procurement. Currently, only four Tier 1 projects with active contracts from 2017 to 2020 remain under the Fixed REC price structure, or 5%.

The Index REC price structure offers a variable monthly payment depending on the reference energy and reference capacity prices calculated for that month. The Proponent bids a fixed strike price that gets adjusted by the Index REC price formula over the Contract Term.

| Year | Procurement Target (Tier 1 RECs) | Awarded Contracts (Tier 1 RECs) | Percentage of Target Awarded |

| 2017 | 1.5 million | 3.9 million | 260% |

| 2018 | 1.5 million | 3.9 million | 260% |

| 2019 | 1.5 million | 2.6 million | 170% |

| 2020 | 1.6 million | 4.1 million | 260% |

Bid Price Trends

The 2021 Tier 1 procurement bid prices have not yet been made publicly available for the twenty-two projects awarded contracts. However, it is expected that they will be made available in Q2/Q3 2023.

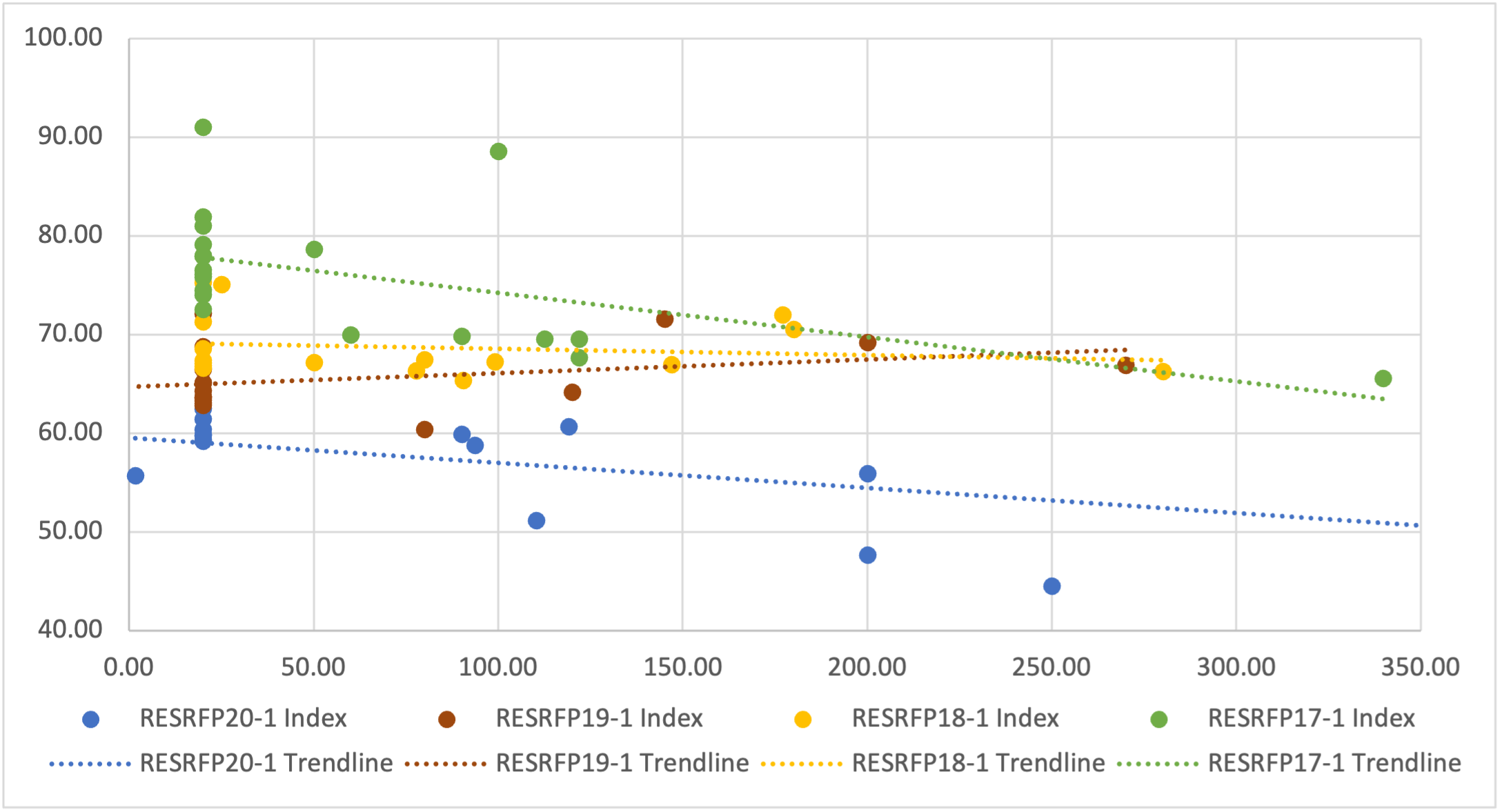

The chart below displays the Index REC pricing by procurement year from 2017 to 2020. As expected with economies of scale, we tend to see an inverse relationship between bid price and project size (MW), where the bid price decreases as the project size increases. A popular project size of 19.99 MW is noted across the four procurements, as this project size minimizes the bid fee (20 MW threshold) and environmental permitting obligations (25 MW threshold), while maintaining adequate economies of scale. Currently almost 50% of contracted projects are 19.99 MW or less in size.

Of the publicly available bid prices posted, we can see that pricing has decreased year over year from 2017 to 2020. About 75% of the bid proposals received in 2020 were submitted with Index REC bid prices (strike prices) below the lowest value from the year prior (2019). It is noted that of the canceled 2020 projects, three do not have publicly available bid prices, which indicates that a contract was never executed, and the other three have the lowest bid prices of the contracted projects in 2020, indicating perhaps that the bid price was not sufficient to successfully develop the project.

| Year | Average Size (MW) | Index REC Bid Price ($/MWh) | ||

| Average | Lowest | Highest | ||

| 2017 | 58 | 75.95 | 65.62 | 91.09 |

| 2018 | 83 | 68.72 | 65.39 | 75.32 |

| 2019 | 61 | 65.58 | 60.40 | 72.19 |

| 2020 | 96 | 56.85 | 44.55 | 62.50 |

Contract Attrition

NYSERDA has seen a significant amount of attrition in awarded Tier 1 projects. Procurements in 2017, 2018, and 2020 saw 50%-60% attrition of those years’ procurement targets. The current contract attrition rate from 2017 to 2021 dropped to 14% with the addition of the newly awarded contracts in 2021. However, it is too early to tell what percentage of 2021 contracts may be cancelled.

To date, 14% of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects.

Continuing NYSERDA’s efforts to pre-emptively screen for unviable projects, NYSERDA once again increased certain Minimum Threshold Requirements, which would ultimately prevent an immature or unproven project from receiving a contract award. Further to this, in 2021, NYSERDA introduced the Non-Viability Determination, which would authorize the Technical Evaluation Panel (“TEP”) to reject a Bid Proposal based upon a unanimous determination by the TEP that the project is not presently viable. Reasons for a determination of non-viability may include:

Technical Evaluation Panel (TEP) – Members of NYSERDA Staff, New York State Department of Public Service Staff, and competitively-selected Independent Evaluators responsible for evaluating Bid Proposals received through this RFP.

- The Bid Proposal is immature to such an extent that it would be impossible to ascertain whether it is viable;

- The Bid Proposal is predicated on unrealistic economic or regulatory assumptions; or

- The Bid Proposal is subject to serious economic or regulatory risks without a sufficient mitigation plan.

As noted in the 2020 White Paper, a project that offers a very low, perhaps an unrealistically low REC price could score well enough on the price criterion to be selected, despite receiving the lowest possible score on the project viability criterion. Selecting such projects for award would have a high likelihood for contract attrition and could jeopardize NYSERDA’s 70 by 30 Target. It is the intention of the Non-Viability Determination to avoid this situation.

Adjustments to the Scoring Matrix

The 2020 White Paper recommended that the Project Viability category and Operational Flexibility and Peak Coincidence category, each worth 10%, be combined into a single category worth 20% of the total score. The reason for the proposed change is that considerations in the Operational Flexibility and Peak Coincidence category will be increasingly intertwined with Project Viability as the penetration of renewable energy increases. Projects that are operationally flexible (dispatchable) and peak coincident will also be those most likely to avoid curtailment, local reliability constraints, and burdensome interconnection requirements. Consolidating these categories will allow evaluators to better reward projects that are truly exceptional across these metrics. The 2021 Tier 1 procurement incorporated this adjustment to the scoring matrix.

| Item | Points |

| Bid Price | 70 |

| Project Viability, Operational Flexibility & Peak Coincidence | 20 |

| Economic Benefits to NYS | 10 |

| Total | 100 |

Increase in Minimum Threshold Requirements

In 2021, the Minimum Threshold Requirements were updated across two of the Project Viability categories: Interconnection and Permitting. Two additional categories were added: Energy Deliverability and Peak Coincidence.

The Interconnection Minimum Threshold Requirement appears to have been maintained at NYISO Interconnection Stage 5, that a System Reliability Impact Study (“SRIS”) or System Impact Study (“SIS”) is in progress, however the required minimum evidence was updated to include evidence of deposit and fees paid to commence the SRIS/SIS.

With the updated scoring matrix, which combines the Operational Flexibility and Peak Coincidence categories within the Project Viability categories, Energy Deliverability became a new Minimum Threshold Requirement category.

NYISO Interconnection Status Key

1=Scoping Meeting Pending, 2=FES Pending, 3=FES in Progress, 4=SRIS/SIS Pending, 5=SRIS/SIS in Progress, 6=SRIS/SIS Approved, 7=FS Pending, 8=Rejected Cost Allocation/Next FS Pending, 9=FS in Progress, 10=Accepted Cost Allocation/IA in Progress, 11=IA Completed, 12=Under Construction, 13=In Service for Test, 14=In Service Commercial, 0=Withdrawn

In the previous procurement the Proposer had the opportunity to score points by “demonstrating with currently available knowledge, that their proposed point of delivery into the NYCA, along with their proposed interconnection and transmission and/or distribution upgrades, is sufficient to ensure full energy dispatch of the Bid Facility’s expected generation output.” (RESRFP20-1) In 2021, the scoring opportunity was maintained with an increased focus on the importance of “the benefits afforded to the electric grid in light of the CES goals to expand the share of renewable energy as a portion of total energy consumed in New York State to 70 percent by the year 2030 (“70 by 30 Target”), including benefits to address grid congestion and delivery constraints, and the extent to which a Proposer can demonstrate that the Bid Facility can deliver firm power (e.g., Bid Quantity as proposed to NYSERDA) to the electrical system without adversely impacting the generation output profile of both existing and planned renewable generators.” (RESRFP21-1)

In addition to the robust Permitting Plan requirement introduced in the previous solicitation, the Permitting Minimum Threshold Requirement increased in 2021 to require a minimum level of permitting studies based on the expected permitting process of the proposed Bid Facility. Bid Facilities proceeding through the Office of Renewable Energy Siting (“ORES”) must provide evidence that the following studies have been completed: 1) Wildlife Characterization Report, 2) Draft Desktop Wetlands and Water Resources Delineation, and 3) Phase IA Archeological Desktop Survey.

Peak Coincidence was also named as a new Minimum Threshold category in 2021, however the inputs required by a Proposer are quite minimal and appear to be covered by the Interconnection and Energy Deliverability categories. In this category, NYSERDA will evaluate how closely the Bid Facility’s expected generation profile matches future estimates of NYISO load, and how the Bid Facility completements other renewable generation already under contract to New York State.

We’ve detailed the top mistakes to avoid when preparing a bid submission for a Renewable Energy RFP. Feel free to take a read of our blog post “Avoid These 3 Common Mistakes in Your Energy Procurement Bid Submission” for more information and how to lead to a successful bid strategy.

Incremental Economic Benefits to New York State

Incremental Economic Benefits to New York State, representing 1/3rd of the 30 non-price points, ranks bid submissions on the extent of eligible expenditures committed to. Eligibility begins from RFP Release Date through the life of the contract. NYSERDA continued their prioritization of Disadvantaged Communities and stated that “NYSERDA will more favorably evaluate economic benefits to New York State that will be realized in part or in full by Disadvantaged Communities as part of the proposed projects’ development.” New York’s Climate Act recognizes that climate change does not affect all communities equally. The Climate Act charged the Climate Justice Working Group (“CJWG”) with the development of criteria to identify disadvantaged communities to ensure that frontline and otherwise underserved communities benefit from the state’s historic transition to cleaner, greener sources of energy, reduced pollution and cleaner air, and economic opportunities. NYSERDA offers a map tool online, which can help to identify Disadvantaged Communities.

NYSERDA introduced a third category of economic benefits, Investments/Commitments to Local Economic and Workforce Development. This category is evaluated based on firmness, credibility, and maturity of the commitments. Commitments under this category include apprenticeships, internships, training, etc. Proposers are encouraged to work with the host community or Authority Having Jurisdiction (AHJ) to determine if there are economic benefit opportunities that could be uniquely afforded to one or more local organizations or groups.

Economic Benefits in category 1 (long-term) and category 2 (short-term) committed to, up to Contract Year 3, form part of the contract and as such must be verified by an independent certified public accountant (“CPA”). If the Economic Benefits Report evaluated by the independent CPA cannot verify that at least 85% of the committed spending occurred in NYS and as stated, then NYSERDA has the right to adjust the monthly REC price payable for the remainder of the contract term by a percentage equal to the deficit noted in through the verification process. Due to the above, Economic Benefits that occur prior to the end of Contract Year 3 are prioritized over commitments that may occur further in the future.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—