Recap of NYSERDA’s 2020 Tier 1 Solicitation

NEW YORK’S LARGE SCALE RENEWABLES RFP

Highlights

- Annual Procurement Targets: From 2017 to 2020, NYSERDA has procured on average 250% of their annual procurement targets;

- Contract Attrition: About 1/5th of awarded contracts over the 2017 to 2020 time period have been canceled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects;

- Bid prices: Bid prices have come down from 2017 to 2020. Additionally, we see lower bid prices associated with larger projects, likely due to economies of scale;

- Bid Price Structure: Since the introduction of the Index REC price structure in 2020, all awarded contracts have employed the Index REC. Currently, only 5% of contracts awarded up to 2020 employ the Fixed REC price structure;

- Increase and Addition of Minimum Threshold Requirements: Interconnection, Permitting, and Financing Project Viability categories all saw an increase in the minimum requirements in 2020, in an attempt to weed out non-viable projects and reduce contract attrition. A new category, Embodied Carbon and Carbon Emissions, was added; and

- Economic Benefits Priorities: The concept of Disadvantaged Communities was introduced, where economic benefits that could be direct in whole or in part to these communities would be prioritized.

New York State Energy Research and Development Authority (“NYSERDA”) has procured large-scale renewables through the Renewable Energy Standard Tier 1 program since 2017. The 4th annual Tier 1 procurement in 2020 resulted in awards for twenty-one solar projects, including three with energy storage, and one hydroelectric facility, to develop 2,111 megawatts (“MW”) of new, renewable energy capacity throughout New York State. The awarded contracts support the development of 30 megawatts, or 120 megawatt-hours (“MWh”), of utility-scale energy storage.

Annual Procurement Targets & Timelines

The 2020 Tier 1 procurement target was approximately 1.6 million Tier 1 eligible Renewable Energy Certificates (“RECs”), up slightly from the previous year’s targets. NYSERDA procured three times their 2020 target, which was a similar case for the previous three Tier 1 procurements.

| Year | Procurement Target (Tier 1 RECs) | Awarded Contracts (Tier 1 RECs) | Percentage of Target Awarded |

| 2017 | 1.5 million | 3.9 million | 260% |

| 2018 | 1.5 million | 3.9 million | 260% |

| 2019 | 1.5 million | 2.6 million | 170% |

| 2020 | 1.6 million | 4.1 million | 260% |

Tier 1 Program – New Renewables

The Renewable Energy Standard Tier 1 program is aimed at increasing new renewable energy development in New York State. Eligible Tier 1 resources include generators of electricity through the use of the following technologies: solar thermal, solar PV, on-land and offshore wind, hydroelectric, geothermal electric, geothermal ground source heat, tidal energy, wave energy, ocean thermal, and fuel cells which do not utilize a fossil fuel resource in the process of generating electricity, that entered commercial operation on or after January 1, 2015.

Due to delays mainly caused by COVID-19, the typical timeline for the issuance of the Tier 1 procurement was pushed back from late April to late July 2020, causing about a 3-month delay. NYSERDA surveyed developers to understand whether or not delaying the procurement further would be helpful or harmful. Bid packages were ultimately submitted in late October 2020. This initial delay led to further delays in the review of bid packages and contract award notifications and ultimately caused contract negotiations to bleed into 2021.

Bid Price Structures

Introduction of the Index REC Price Structure

The Tier 1 procurements were amended on January 16, 2020 by the Order Modifying Tier 1 Renewable Procurements, whereby the Public Service Commission (“PSC”) directed NYSERDA to offer bidders an Index REC price option in future RES solicitations, beginning with RESRFP20-1.

The 2020 Tier 1 procurement saw the introduction of the Index REC price structure. The Index REC price structure offers a variable monthly payment depending on the reference energy and reference capacity prices calculated for that month. The Proponent bids a fixed strike price that gets adjusted by the Index REC price formula over the Contract Term. While NYSERDA still allows Proponent’s to bid a Fixed REC, since the introduction of the Index REC price structure, all contracted projects have been Index REC proposals. In early 2021, previously contracted projects with a Fixed REC price structure were offered an opportunity to convert to an Index REC price structure. Currently, only four Tier 1 projects with active contracts from 2017 to 2020 remain under the Fixed REC price structure, or 5%.

Bid Price Trends

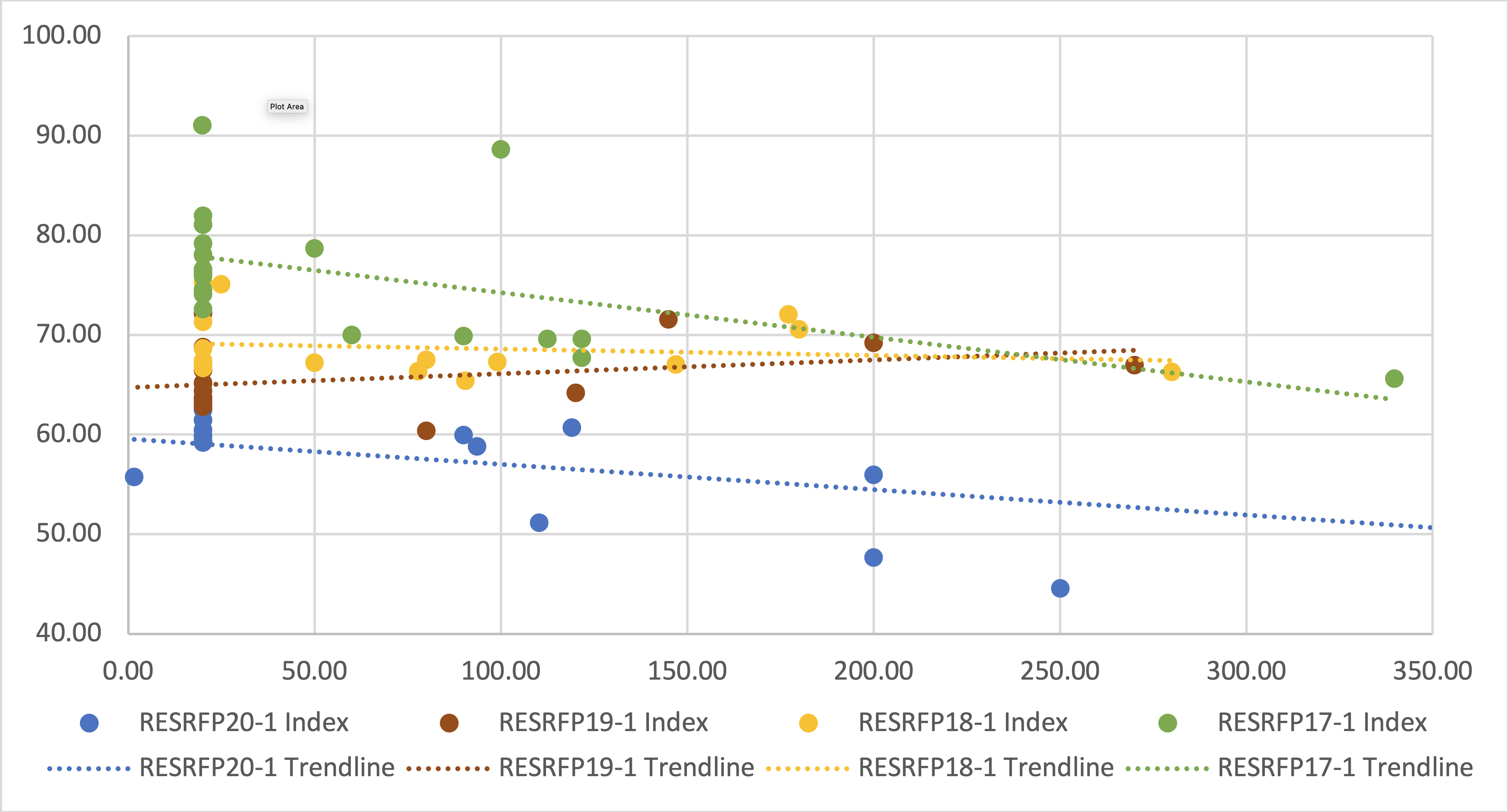

The chart below displays the Index REC pricing by procurement year from 2017 to 2020. As expected with economies of scale, we tend to see an inverse relationship between bid price and project size (MW), where the bid price decreases as the project size increases. A popular project size of 19.99 MW is noted across the four procurements, as this project size minimizes the bid fee (20 MW threshold) and environmental permitting obligations (25 MW threshold), while maintaining adequate economies of scale. Currently almost 50% of contracted projects are 19.99 MW or less in size.

Of the publicly available bid prices posted, we can see that pricing has decreased year over year from 2017 to 2020. About 75% of the bid proposals received in 2020 were submitted with Index REC bid prices (strike prices) below the lowest value from the year prior (2019). It is noted that of the canceled 2020 projects, three do not have publicly available bid prices, which indicates that a contract was never executed, and the other three have the lowest bid prices of the contracted projects in 2020, indicating perhaps that the bid price was not sufficient to successfully develop the project.

| Year | Average Size (MW) | Index REC Bid Price ($/MWh) | ||

| Average | Lowest | Highest | ||

| 2017 | 58 | 75.95 | 65.62 | 91.09 |

| 2018 | 83 | 68.72 | 65.39 | 75.32 |

| 2019 | 61 | 65.58 | 60.40 | 72.19 |

| 2020 | 96 | 56.85 | 44.55 | 62.50 |

Contract Attrition

NYSERDA has seen a significant amount of attrition in awarded Tier 1 projects. Procurements in 2017, 2018, and 2020 saw 50%-60% attrition of those years’ procurement targets. However, due to the substantial over-procurement across those years, this translates to just under 20% contract attrition from 2017 to 2020. Included in the canceled 2020 contracts, was 20 MW of energy storage or 80 MWh of storage capacity.

About 1/5th of awarded contracts have been cancelled, representing 2.7 million MWh of Tier 1 RECs or just over 1GW of projects.

In an effort to pre-emptively screen for unviable projects, NYSERDA began their trend of increasing certain Minimum Threshold Requirements, which would ultimately prevent an immature or unproven project from receiving a contract award.

Increase in Minimum Threshold Requirements

In 2020, the Minimum Threshold Requirements were increased across three of the Project Viability categories: Interconnection, Permitting, and Financing.

The Interconnection Minimum Threshold Requirement increased from simply having submitted a valid interconnection request and providing evidence of initial fee payment, to requiring that a System Reliability Impact Study (“SRIS”) or System Impact Study (“SIS”) is in progress. In terms of New York Interconnection System Operator’s (“NYISO”) interconnection status key, that is an increase from Stage 1 all the way to Stage 5. This drastic escalation in minimum required interconnection progress set the bar high and eliminated immature projects from being eligible to submit in the 2020 Tier 1 procurement.

NYISO Interconnection Status Key

1=Scoping Meeting Pending, 2=FES Pending, 3=FES in Progress, 4=SRIS/SIS Pending, 5=SRIS/SIS in Progress, 6=SRIS/SIS Approved, 7=FS Pending, 8=Rejected Cost Allocation/Next FS Pending, 9=FS in Progress, 10=Accepted Cost Allocation/IA in Progress, 11=IA Completed, 12=Under Construction, 13=In Service for Test, 14=In Service Commercial, 0=Withdrawn

The Permitting Minimum Threshold Requirement increased in 2020 to require a robust Permitting Plan document following NYSERDA’s detailed guidance provided in an appendix. The guidance document details a hierarchal mitigation approach as well as the potential requirement to make mitigation payments where projects overlapped with Mineral Soil Groups 1-4. The Permitting Plan must demonstrate a full understanding of the potential environmental and agricultural impacts of the project and feasible plans to mitigate such impacts.

The Project Development Minimum Threshold Requirement category was expanded to include Project Financing and Proposer Creditworthiness. A requirement for a detailed financing plan, that demonstrates the financial capability to complete construction by the proposed commercial operation date was added. Organizational charts, management charts, and audited financial statements are a few of the required attachments to the newly required financial plan.

The 2020 Tier 1 procurement introduced a new Project Viability category, which added another Minimum Threshold Requirement to the bid submissions. The Carbon Emissions and Embodied Carbon category required Proposers to describe efforts that have or can be undertaken to minimize the project’s embodied carbon intensity, as well as provide an explanation of any available process to account for embodied carbon on an ongoing basis through development, construction, and operation of the project.

We’ve detailed the top mistakes to avoid when preparing a bid submission for a Renewable Energy RFP. Feel free to take a read of our blog post “Avoid These 3 Common Mistakes in Your Energy Procurement Bid Submission” for more information and how to lead to a successful bid strategy.

Incremental Economic Benefits to New York State

Incremental Economic Benefits to New York State, representing 1/3rd of the 30 non-price points, ranks bid submissions on the extent of eligible expenditures committed to, eligibility begins from RFP Release Date through the life of the contract. NYSERDA introduced the concept of a Disadvantaged Community and stated that “NYSERDA will more favorably evaluate economic benefits to New York State that will be realized in part or in full by Disadvantaged Communities as part of the proposed projects’ development.” New York’s Climate Act recognizes that climate change does not affect all communities equally.

| Item | Points |

| Bid Price | 70 |

| Project Viability Categories | 10 |

| Operational Flexibility / Peak Coincidence | 10 |

| Economic Benefits to NYS | 10 |

| Total | 100 |

The Climate Act charged the Climate Justice Working Group (“CJWG”) with the development of criteria to identify disadvantaged communities to ensure that frontline and otherwise underserved communities benefit from the state’s historic transition to cleaner, greener sources of energy, reduced pollution and cleaner air, and economic opportunities. NYSERDA offers a map tool online, which can help to identify Disadvantaged Communities.

Economic Benefits committed to, up to Contract Year 3, form part of the contract and as such must be verified by an independent certified public accountant (“CPA”). If the Economic Benefits Report evaluated by the independent CPA cannot verify that at least 85% of the committed spending occurred in NYS and as stated, then NYSERDA has the right to adjust the monthly REC price payable for the remainder of the contract term by a percentage equal to the deficit noted in through the verification process. Due to the above, Economic Benefits that occur prior to the end of Contract Year 3 are prioritized over commitments that may occur further in the future.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—