Empowering Clean Tech Investments: Your Essential Guide to Prevailing Wage Benchmarking for ITC Labour Compliance

Author: Rachelle Lynne-Davies, P.Eng.

A series of ITC blogs from Compass Energy Consulting.

As the clean technology sector continues to grow, ensuring compliance with labour requirements is crucial for businesses seeking to maximize the benefits of the Clean Technology Investment Tax Credit (“CTITC”). One key aspect of this compliance is understanding the prevailing wage requirements that protect covered workers. This guide will cover the essentials, including definitions and step-by-step instructions on conducting prevailing wage benchmarking.

Understanding Covered Workers

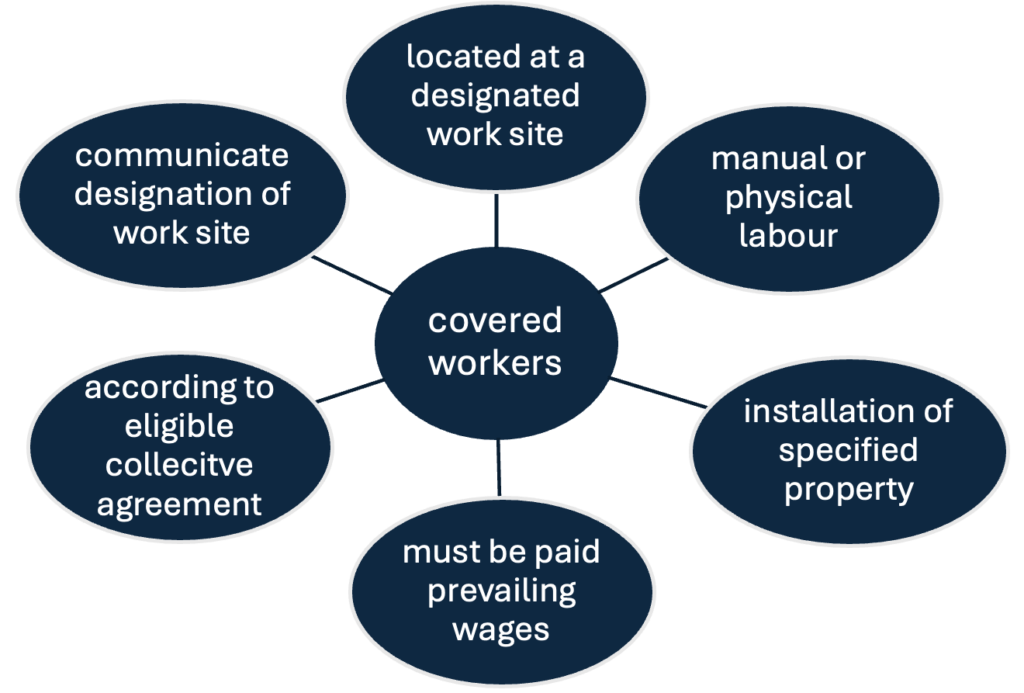

Covered workers are individuals engaged in the preparation or installation of eligible property at a designated work site, and whose duties are primarily manual or physical in nature. Covered workers are not administrative, clerical, executive employees, or business visitors to Canada. Covered workers must be paid prevailing wages for their work on site, which are reflective of local labour market standards.

The Prevailing Wage Requirement

The prevailing wage requirement mandates that covered workers receive at least the local prevailing wage for their specific job classifications. These hourly wage rates are determined based on eligible collective agreements. Covered workers may already be subject to an eligible collective agreement, however in cases where that is not true, the prevailing wage benchmarking activity is necessary.

As per the federal legislation, the incentive claimant must attest that it has met the prevailing wage requirement, but that it has also caused the entire covered worker labour supply chain to meet the requirement. Evidence of this is expected form part of the Canada Revenue Agency (“CRA”) audit.

Eligible Collective Bargaining Agreements

An eligible collective bargaining agreement (“eligible CBA”) is defined by 1) the parties it applies to, 2) the date it became effective, and 3) applicability to the project and scope of work.

An eligible CBA is a contract negotiated between two parties, one being a trade union that is an affiliate of Canda’s Building Trades Unions (“CBTU”) and the other being a multi-employer entity. Eligible CBAs must also be the most recent agreement and must most closely align with the covered worker’s experience level, tasks and location, calculated on a perhour or similar basis. In order to ensure that covered workers are paid prevailing wages, the first step is establishing eligible CBAs to reference.

How to Conduct Hourly Wage Benchmarking

To effectively benchmark hourly wages for compliance, follow these steps:

- Gather Data: Collect information on hourly wage rates from reliable sources, such as CBTU’s ITC Portal, available here: https://buildingtrades.ca/en/investment-tax-credit-portal/. This data will help establish the prevailing wage for specific job classifications in your area.

- Identify Job Classifications: Clearly define the job classifications for the covered workers involved in your project. Each classification should have a corresponding hourly wage rate based on the collected data.

- Benchmark Prevailing Wages by Job Classification: Ensure that the data pulled from eligible CBAs aligns with the definition of a prevailing wage as per the Federal Legislation, which includes benefits such as vacation, pension, health and welfare, but does not include other fees such as union fees paid to funds.

- Compare Wage Rates: Assess the wage rates being paid to your covered workers against the prevailing wage data. Identify any discrepancies where workers may not be receiving the appropriate compensation. Be sure that the wage rates paid to your covered workers includes any benefits that they are entitled to.

- Adjust Compensation: If discrepancies exist, determine the necessary top-up payments or adjustments needed to ensure compliance with the prevailing wage requirement.

- Documentation: Keep thorough records of your benchmarking process, including data sources, wage comparisons, and any adjustments made. This documentation will be invaluable for compliance verification and audits.

By following these steps and understanding the essential components of labour compliance, businesses can empower their clean tech investments while ensuring fair compensation for covered workers. For more guidance on navigating CTITC compliance and labour standards, consider reaching out to experts in the field, like Compass Energy Consulting, who can provide tailored support for your clean technology projects.

Why Compass?

At Compass Energy Consulting, we are dedicated to guiding our clients through the intricacies of the CTITC labour compliance requirements, helping you ensure that your projects meet prevailing wage standards, and safeguarding the full value of the CTITC. By partnering with us, you can protect the full value of these essential tax credits, thus maximizing your investment’s potential.

If you’re looking for expert support in labour compliance, don’t hesitate to reach out to me at rachelle@compassenergyconsulting.ca. Together, we can help you navigate the compliance landscape and protect your business’ interests while leveraging the benefits of clean technology investments.

Check Out Our Other Blogs in the ITC Series

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC

- Empowering Clean Tech Investments: Your Essential Guide to Prevailing Wage Benchmarking for ITC Labour Compliance

Addressing Wage Gaps: Best Practices for Retroactive Top-Up Payments in Clean Tech ITC Labour Compliance

Author: Rachelle Lynne-Davies, P.Eng.

A series of ITC blogs from Compass Energy Consulting.

In the rapidly evolving landscape of clean technology, the Clean Technology Investment Tax Credit (CTITC) serves as a critical incentive for businesses to invest in renewable energy solutions. Designed to support initiatives that reduce greenhouse gas emissions, the CTITC also emphasizes compliance with labour standards, particularly concerning wage requirements for workers involved in funded projects.

Key Definitions: Understanding the Terminology

Before diving into compliance practices, it’s essential to clarify some key terms:

- Covered Worker: This refers to any individual engaged in the preparation or installation of eligible property on a project that qualifies for the CTITC, including laborers, electricians, mechanics, apprentices, and any other role that is primarily manual or physical in nature. These workers are entitled to specific wage protections under the prevailing wage laws.

The Prevailing Wage Requirement

Under the CTITC, covered workers must be paid prevailing wages—an hourly wage rate as per an eligible collective bargaining agreement for specific job classifications. This requirement is designed to ensure that workers are compensated fairly and equitably for their labour, reflecting the prevailing wage rates applicable in the area or region. Adhering to this requirement not only supports fair labour practices but also helps maintain a level playing field among businesses competing for government incentives.

What to Do When Prevailing Wages Are Not Paid: Understanding Top-Up Payments

Prior to filing taxes, in situations where it is discovered that covered workers have not been paid the prevailing wage, businesses must take corrective action through retroactive top-up payments. These payments are meant to close the wage gap, compensating workers for the difference between what they were paid and what they should have received according to prevailing wage standards. It is crucial for employers to promptly assess their payroll records, identify any discrepancies, and take necessary steps to rectify the situation. Ensuring prevailing wages have been paid to all covered workers will safeguard against financial penalties down the road.

The Financial Penalties of Non-Compliance

Failing to comply with the prevailing wage requirements can lead to financial penalties. In cases of non-compliance, it is expected that employers will face fines and will be required to repay all missed wages with interest. It is important to note, however, that as long as the non-compliance was not deliberate the full value of the CTITC is protected.

To avoid these repercussions, it is essential for businesses engaged in clean technology projects to understand their responsibilities regarding prevailing wage compliance and to implement robust monitoring systems that ensure all workers are compensated fairly.

Conclusion

The journey toward sustainable investment in clean technology comes with obligations, particularly regarding labour compliance under the CTITC. At Compass Energy Consulting, we are dedicated to guiding businesses through the intricacies of these labour compliance requirements, helping you ensure that your projects meet prevailing wage standards and safeguarding the full value of the CTITC. By partnering with us, you can effectively address any wage discrepancies and maintain your eligibility for essential tax credits, thus maximizing your investment’s potential.

If you’re looking for expert support in labor compliance, don’t hesitate to reach out to me at rachelle@compassenergyconsulting.ca. Together, we can help you navigate the compliance landscape and protect your business’s interests while leveraging the benefits of clean technology investments.

Check Out Our Other Blogs in the ITC Series

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC

Penalty for Non-Compliance Could Be 50% of the ITC

Author: Rachelle Lynne-Davies, P.Eng.

The third in a series of ITC blogs from Compass Energy Consulting

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — This Blog

Where the incentive claimant claims the regular tax credit rate of 30%, but it is determined that the labour requirements are not met, there are financial penalties incurred by the incentive claimant which will be added to the tax payable for the installation taxation year. It is important to note that the financial penalties are significantly different whether or not gross negligence is determined to have caused the non-compliance.

Assuming gross negligence was not a factor, non-compliance with the prevailing wage requirement results in a financial penalty equivalent to $20 for each day in the installation tax year that a covered worker was not paid the prevailing wage.

EXAMPLE

Let’s assume it was determined that the incentive claimant that claimed the regular tax credit rate for the installation tax year did not pay 75 covered workers the correct prevailing wage for their labour hours on-site for a period of 6 months from Jan 1 , 2024 to June 30, 2024.

The financial penalty equivalent to $20 x 126 working days x 75 covered workers = CAD $189,000 would be added as tax payable for the installation tax year. It is important to note that the incentive claimant’s eligibility for the regular tax credit rate of 30% is not affected by this marginal non-compliance.

Again assuming gross negligence was not a factor, non-compliance with the apprenticeship requirement results in a financial penalty for the claim year equal to the following: $50 x (A – B), where A is the total number of hours of labour required to be performed by apprentices registered in a Red Seal trade for the installation tax year, and B is the total number of actual hours performed by apprentices.

EXAMPLE

Let’s assume it was determined that the incentive claimant that claimed the regular tax credit rate for the installation tax year did not meet the 10% apprenticeship requirement. The target apprenticeship percentage was 10,000 hours but only 9,455 hours were performed. For clarity, there were no applicable laws or clauses of an eligible collective agreement that prevented the incentive claimant from meeting the 10% apprenticeship requirement.

The financial penalty equivalent to $50 x (10,000 – 9,455) = CAD $27,250 would be added as tax payable for the installation tax year. Again, it is important to note that the incentive claimant’s eligibility for the regular tax credit rate of 30% is not affected by this marginal non-compliance.

If it is determined by the Minister that the non-compliance was known or the result of gross negligence, the financial penalties are more severe. The incentive claimant will not be eligible for the regular tax credit rate and will only be entitled to not more than the reduced tax credit rate of 20%. Additionally, the incentive claimant is liable to a penalty for the claim year equal to the following: 50% x (A – B), where A is the amount of tax credit claimed at the regular tax credit rate, and B is the amount of tax credit that the incentive claimant would be entitled to claim at the reduced tax credit rate. This penalty amounts to 5% of the total tax credit amount expected through the Clean Tech ITC at the regular tax credit rate. Together, the financial penalties sum to 50% of the original expected refundable tax credit.

EXAMPLE

For a 100MW wind farm located in Saskatchewan, which has eligible capital costs of CAD $200 million, the expected Clean Tech ITC at the regular tax credit rate is expected to be CAD $60 million.

Assuming the regular tax credit rate was claimed, but the Minister determined that non-compliance was the result of gross negligence, the taxpayer would only be eligible for the reduced tax credit rate, a reduction of $20 million and an additional financial penalty of $10 million for gross negligence could be applied. This is a total financial penalty of $30 million, or 50% of the original expected ITC.

Financial penalties for non-compliance should be avoided altogether. A structured compliance plan will set a strong foundation to ensure you are able to realize the full value of the ITC without risk of claw backs due to non-compliance.

The Need for Compliance Management Support

It would be detrimental to project stakeholders to incur additional financial penalties for non-compliance whether it is gross negligence or an honest mistake. Mismanagement of the compliance activities to meet the labour requirements is an avoidable error.

The labour and apprenticeship requirements give rise to the need for compliance planning, monitoring, and data management of evidence.

Why Compass Energy Consulting?

Founded in 2011, Compass has been providing regulatory and compliance support to the renewable energy marketplace throughout Canada and the Northeastern U.S. for over a decade. Compass’ founders helped to design some of the largest Domestic Content compliance obligations for renewable energy procurements, like those found in Ontario’s Feed-in Tariff program, and our team of consultants help developers participate and win in some of the largest procurements, like NYSERDA’s Tier 1 REC RFP.

Compass is uniquely positioned to provide a turn-key compliance, monitoring, and audit service due to our experience providing these types of services to over 200 MW of projects under Ontario’s Feed-in Tariff 1 and 2 Domestic Content compliance regime. Our compliance assessments were provided for project owners but importantly were relied upon by project lenders to ensure projects satisfied this critical and binary contractual obligation.

Compass Energy Consulting is your insurance policy for your ITC. Feel free to reach out to me at rachelle@compassenergyconsulting.ca to discuss further.

Check Out Our Other Blogs in the ITC Series

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — This Blog

Making Sense of the ITC Labour Requirements

Author: Rachelle Lynne-Davies, P.Eng.

The second in a series of ITC blogs from Compass Energy Consulting

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon

Compliance with the ITC labour requirements is critical to securing the full value of the Clean Technology Investment Tax Credit (“Clean Tech ITC”). Non-compliance could mean additional financial penalties in addition to putting your ITC eligibility at risk.

As we discussed previously, the Clean Tech ITC incentivizes the deployment of renewables and energy storage in Canada by offering an up-to 30% tax credit for investments in eligible renewable energy projects. The regular tax credit rate requires compliance with the labour requirements for an added 10% portion. The reduced tax credit rate refers to the 20% base.

The labour requirements consist of two compliance obligations for covered workers: 1) prevailing wage requirement, and 2) apprenticeship requirement.

Covered Workers

It is important to note that not all on-site labourers are covered workers. Covered workers are those on-site labourers that are engaged in the preparation or installation of specified property at a designated work site, whose duties are primarily manual or physical in nature, and who is not administrative, clerical, an executive employee, or a business visitor to Canada.

Specified property (or “Clean Technology Property”) in the definition of a covered worker refers to the eligible properties under the Clean Tech ITC. As per section 127.46 subsection (3) of the federal legislation, covered workers must be paid prevailing wages for their labour on-site.

Prevailing Wage Requirement

Covered workers must be paid prevailing wages according to: i) the terms of an eligible collective agreement that applies to the worker or ii) in an amount that is at least equal to the terms of an eligible collective agreement that most closely aligns with the covered worker’s experience level, tasks and location. See Figure below.

Figure 1. Covered Worker Diagram

If the covered workers at your designated work site are not union workers, they will be required to be paid prevailing wages at least equal to the most recent multi-employee collective bargaining agreement negotiated with a trade union (that is an affiliate of Canada’s Building Trades Unions) for a given trade in a region or province or similar Project Labour Agreement (“PLA”) or prescribed agreement.

The incentive claimant is ultimately responsible for the compliance of all covered workers on-site. The incentive claimant or taxpayer must attest that not only has it met the prevailing wage requirement for its own employees that are covered workers (if any), but that it has taken reasonable steps to ensure that any covered workers employed by any other person or partnership at the designated work site are compensated accordingly.

Additionally, to ensure that on-site covered workers are aware of this prevailing wage requirement, it must be communicated, via poster or notice, that is visible and accessible to on-site covered workers (physical or electronic), that confirms that the work site is subject to prevailing wage requirements in relation to covered workers. This notice must include a plain language explanation of what that means for workers and information regarding how to report failures to pay prevailing wages to the Minister.

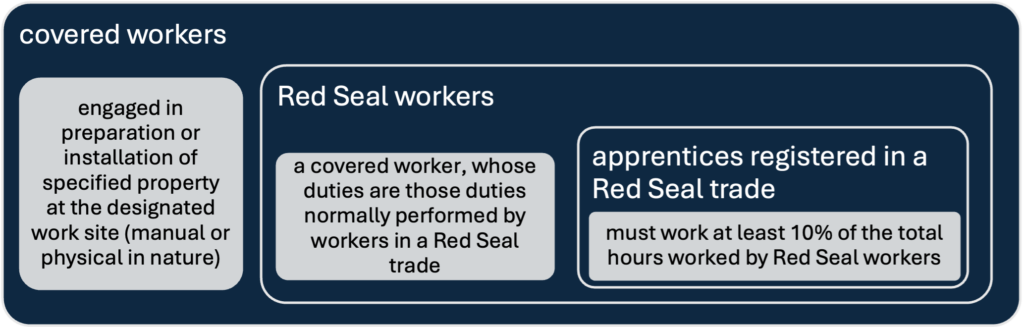

Apprenticeship Requirement

The federal legislation (127.46 subsection (5)) requires that apprentices registered in a Red Seal trade work at least 10% of the total hours that are worked during the year by Red Seal workers at a designated work site of the incentive claimant on the preparation or installation of specified property.

This compliance requirement necessitates the continuous tracking of labour hours by all Red Seal workers, which may be a subset of covered workers, and apprentices registered in a Red Seal trade to ensure that the minimum 10% apprenticeship target remains on track. Not all on-site preparation and installation of specified property may be duties that are normally performed by workers in a Red Seal trade or other equivalent provincially registered trade. See Figure below.

Figure 2. Relationship of Apprentice Hours to Red Seal Workers to Covered Workers

Adjustments to the 10% apprenticeship target may only be made if an applicable law or collective agreement either specifies a maximum ratio of apprentices to journeypersons or otherwise restricts the number of apprentices on-site. However, the incentive claimant must make reasonable efforts to ensure that the highest possible percentage of the total labour hours performed by Red Seal workers is performed by apprentices registered in a Red Seal trade, while respecting the applicable law or collective agreement.

The incentive claimant is ultimately responsible for the compliance with the 10% apprenticeship requirement for itself, its EPC contractor, and all applicable subcontractors. The incentive claimant or taxpayer must attest that it has met the apprenticeship requirement in respect of covered workers at the designated work site.

Structured Compliance Approach

A structured compliance approach includes establishing a structured plan that sets out requirements, expectations, and targets, conducting monitoring activities at regular intervals to ensure transparency of meeting targets, and utilizing an effective data management system for labour records, which will form the audit binder and be readily available in the event of an audit.

Since the incentive claimant is ultimately responsible for compliance with the labour requirements, it is imperative that a compliance plan is established and communicated through the on-site labour supply chain. It will be critical that the timing of establishing this compliance plan occurs prior to execution of the EPC agreement. It will be critical that the EPC contractor, and in turn all subcontractors, are contractually bound to meet the requirements of prevailing wage and apprenticeship. Part of compliance planning will include establishing the on-site labour supply chain and the approach each on-site contractor will take to meet the labour requirements.

Compliance monitoring will be a critical continuous activity to track on-going compliance and forecast compliance to meet the established targets. Labour hours must be tracked by employee along with a description of the employee’s work duties on-site, the compensation rate, status of Red Seal worker certification or status of apprenticeship registration in a Red Seal trade (as applicable). These labour hour records will be compiled on a monthly basis to track compliance with applicable prevailing wages, total labour hours provided by Red Seal workers, and total labour hours provided by apprentices registered in a Red Seal trade. Compliance monitoring on a monthly basis enables compliance gaps to be identified and rectified before it’s too late.

Compliance evidence will be collected in advance of and throughout the construction period. See Table below for types of compliance evidence that may be included.

Table 1. Compliance Evidence by Requirement

| Compliance Requirement | Compliance Evidence |

| On-site labour supply chain, including EPC contractor and applicable subcontractors, are contractually bound to meet the labour requirements |

|

| EPC contractor and applicable subcontractors are required to pay covered workers the applicable prevailing wage |

|

| EPC contractor and applicable subcontractors are required to meet or exceed the 10% apprenticeship requirement |

|

The Need for Compliance Management Support

It would be detrimental to project stakeholders to misinterpret the eligible and ineligible properties that are defined as Clean Tech Property (or specified property), as it could lead to additional project costs for prevailing wages that are not required, and perhaps more importantly, it could artificially inflate the total Clean Tech ITC that the taxpayer is relying on. Not only would you be including ineligible properties in the capital cost calculation, but you would be paying a premium for the labour and installation of those ineligible properties, all of which is not claimable under the Clean Tech ITC.

The labour and apprenticeship requirements give rise to the need for compliance planning, monitoring, and data management of evidence.

Why Compass Energy Consulting?

Founded in 2011, Compass has been providing regulatory and compliance support to the renewable energy marketplace throughout Canada and the Northeastern U.S. for over a decade. Compass’ founders helped to design some of the largest Domestic Content compliance obligations for renewable energy procurements, like those found in Ontario’s Feed-in Tariff program, and our team of consultants help developers participate and win in some of the largest procurements, like NYSERDA’s Tier 1 REC RFP.

Compass is uniquely positioned to provide a turn-key compliance, monitoring, and audit service due to our experience providing these types of services to over 200 MW of projects under Ontario’s Feed-in Tariff 1 and 2 Domestic Content compliance regime. Our compliance assessments were provided for project owners but importantly were relied upon by project lenders to ensure projects satisfied this critical and binary contractual obligation.

Compass Energy Consulting is your insurance policy for your ITC. Feel free to reach out to me at rachelle@compassenergyconsulting.ca to discuss further.

Check Out Our Next Blog in the ITC Series

Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon

Making Sense of the Federal ITC Legislation

Author: Rachelle Lynne-Davies, P.Eng.

The first in a series of ITC blogs from Compass Energy Consulting

- Making Sense of the Federal ITC Legislation

- Making Sense of the Federal ITC Labour Requirements

- Penalty for Non-Compliance Could Be 50% of the ITC — Coming Soon

The Clean Technology Investment Tax Credit (“Clean Tech ITC”) incentivizes the deployment of renewables and energy storage in Canada by offering an up-to 30% refundable tax credit for investments in eligible projects.

A 100MW wind farm in Saskatchewan, which has eligible capital costs of CAD $200 million and complies with the labour requirements, can expect to claim $60 million in refundable tax credits.

Figure 1. Breakdown of the Regular Tax Credit Rate

While the reduced tax credit rate (20%) is secured simply by incurring eligible capital cost of clean technology property, the added 10% requires compliance with the labour requirements.

With a significant amount of project capital costs on the line, it will be critical for project stakeholders, especially financers and lenders in addition to owners, EPCs, and contractors, to understand the mechanics of the Clean Tech ITC and to ensure labour compliance is met and can be evidenced.

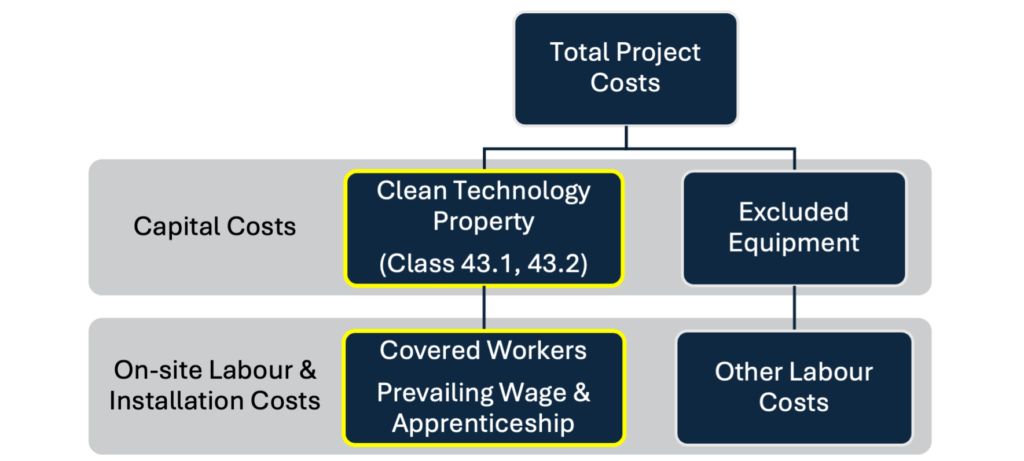

Clean Technology Property

Clean Technology Property is identified as property described in Class 43.1 and 43.2 in Schedule II to the Income Tax Regulations. Nineteen categories of systems and equipment fall under the definition of Clean Technology Property as per specific subsections of Class 43.1 and 43.2. It is important to note that not all project capital costs for those systems are eligible properties. Meaning the 30% tax credit will not be applied to the entire cost of bringing your facility online, nor will all of the on-site labour be required to adhere to the prevailing wage and apprenticeship requirements. Understanding what components of your eligible project are covered and therefore what labour must comply is important in ensuring and facilitating compliance. See Figure below.

Figure 2. Breakdown of Total Project Costs

For starters, “Clean Technology Property” has to satisfy a few requirements:

- It has to be located in Canada;

- It has to be new equipment;

- If leased by the taxpayer, it must be leased to another person or partnership that are taxable Canadian corporations;

- It has to fall under one of the 19 categories of systems and equipment described in (d) of the definition, pointing back to Class 43.1 and 43.2, which includes:

- Equipment used to generate electricity from solar, wind, and water energy (<50MW);

- Stationary electricity storage equipment (including batteries, compressed air, and flywheels);

- Active solar heating equipment and air-source or ground-source heat pumps;

- Non-road zero-emission vehicles and charging or refuelling equipment;

- Equipment used exclusively to generate heat or electricity (or a combo) from geothermal energy;

- Concentrated solar energy equipment; and

- Small modular nuclear reactors.

There are specific equipment that are not included as Clean Technology Property, which are referred to as “excluded property”. These include:

- auxiliary heating or electrical generating equipment that uses any fossil fuel;

- buildings or structures other than those structures described in paragraph (i) of the definition of concentrated solar energy equipment;

- distribution equipment;

- property included in Class 10 in Schedule II to the Income Tax Regulations; and

- property that would be included in Class 17 in Schedule II to the Income Tax Regulations if that Class were read without reference

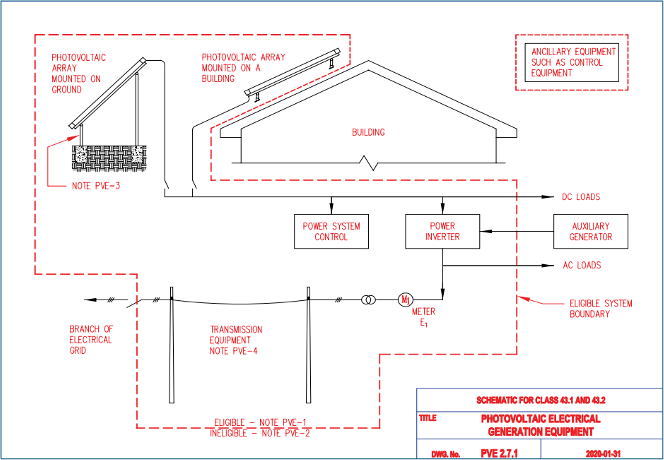

For example, a new-build ground-mounted solar project located in Canada that is used primarily for the purpose of generating electrical energy from solar energy falls under Class 43.1 (d)(vi) as “fixed location solar photovoltaic equipment”. The breakdown of capital costs per section 2.7 of the Technical Guide to Class 43.1 and 43.2 is in the table below.

Table 1. Eligible and Ineligible Properties for Photovoltaic Electrical Generating Equipment

| Eligible Properties | Ineligible Properties |

Purchase and installation of:

|

|

A typical configuration of solar cells or modules and related equipment that would qualify as photovoltaic equipment is shown in the schematic below.

Figure 3. Photovoltaic Electrical Generating Equipment Schematic

As per PV-4 in the technical guide, “Eligible transmission equipment is site specific and is dependent on the electrical grid configuration near the site. In general, it includes transmission lines (and related equipment) from the electrical energy generating equipment up to the interface with the electrical grid or the isolation switch of the local electrical utility, or up to the point where, on an annual basis, more than 75 percent of the electrical energy transmitted by the transmission equipment is electrical energy generated by the photovoltaic electrical generation equipment, whichever point comes first.”

Distribution equipment, which is considered excluded property, is defined in subsection 1104(13) of the Income Tax Regulations as “equipment (other than transmission equipment) used to distribute electrical energy generated by electrical generating equipment.”

On-site Labour and Installation

Since a subset of the total project capital costs are considered eligible property, only that corresponding subset of on-site labour and installation is included in the Clean Tech ITC, however it must comply with the labour requirements to be eligible for the regular tax credit rate.

The federal legislation defines “covered worker” as an individual who is engaged in the preparation or installation of specified property at a designated worksite, whose work duties are primarily manual or physical in nature, and who is not administrative, clerical, an executive employee, or a business visitor to Canada. Specified Property in this definition (127.46) is equivalent to the definition of Clean Tech Property (127.45).

Since covered workers must be paid the prevailing wage for their work on-site for the preparation or installation of specified property, it is extremely important to understand the difference between eligible properties and ineligible properties based on the specific type of renewable energy facility that falls under the definition of Clean Technology Property as per Class 43.1 and 43.2.

Additionally, there are apprenticeship requirements which necessitate the tracking of labour hours performed by Red Seal workers to ensure that at least 10% of those total hours are worked by apprentices registered in a Red Seal trade. This level of compliance monitoring will add a layer of due diligence that would otherwise not be required. It is imperative to have a solid foundation of the mechanics of the Clean Tech ITC and labour requirements before engaging your supply chain and executing contractual documents.

Clean Technology ITC Decreases Over Time

The specified percentage of the Clean Tech ITC begins at 30% and steps down after a decade to 15% and then zero after December 31, 2034. See Table below.

Table 2. Clean Technology ITC Specified Percentage Over Time

| Date | Specified Percentage |

| After Mar 28, 2023 and before Jan 1, 2034 | 30% |

| After Dec 31, 2033 and before Jan 1, 2035 | 15% |

| After Dec 31, 2034 | 0% |

The Need for Compliance Management Support

It would be detrimental to project stakeholders to misinterpret the eligible and ineligible properties that are defined as Clean Tech Property (or specified property), as it could lead to additional project costs for prevailing wages that are not required, and perhaps more importantly, it could artificially inflate the total Clean Tech ITC that the taxpayer is relying on. Not only would you be including ineligible properties in the capital cost calculation, but you may be paying a premium for the labour and installation of those ineligible properties, all of which is not claimable under the Clean Tech ITC.

The labour and apprenticeship requirements give rise to the need for compliance planning, monitoring, and data management of evidence.

Why Compass Energy Consulting?

Founded in 2011, Compass has been providing regulatory and compliance support to the renewable energy marketplace throughout Canada and the Northeastern U.S. for many years. Our team of consultants have helped to design some of the largest Domestic Content compliance obligations for renewable energy procurements, like those found in Ontario’s Feed-in Tariff program, and helped developers participate and win in some of the largest procurements, like NYSERDA’s Tier 1 REC RFP.

Compass is uniquely positioned to provide a turn-key compliance, monitoring, and audit service due to our experience providing these types of services to over 200 MW of projects under Ontario’s Feed-in Tariff 1 and 2 Domestic Content compliance regime. Our compliance assessments were provided for project owners but importantly were relied upon by project lenders to ensure projects satisfied this critical and binary contractual obligation.

Compass Energy Consulting is your insurance policy for your ITC. Feel free to reach out to me at rachelle@compassenergyconsulting.ca to discuss further.

Check Out The Next Blog in the ITC Series

| Definitions

clean technology property means property a) situated in Canada (including property described in subparagraph (d)(v) or (xiv) of Class 43.1 in Schedule II to the Income Tax Regulations that is installed in the exclusive economic zone of Canada) and intended for use exclusively in Canada; b) that has not been used, or acquired for use or lease, for any purpose whatever before it was acquired by the taxpayer; c) that, if it is to be leased by the taxpayer to another person or partnership, is i. leased to a qualifying taxpayer or a partnership all the members of which are taxable Canadian corporations, and ii. leased in the ordinary course of carrying on a business in Canada by the taxpayer whose principal business is selling or servicing property of that type, or whose principal business is leasing property, lending money, purchasing conditional sales contracts, accounts receivable, bills of sale, chattel mortgages or hypothecary claims on movables, bills of exchange or other obligations representing all or part of the sale price of merchandise or services, or any combination thereof; and d) that is i. equipment used to generate electricity from solar, wind and water energy that is described in subparagraph (d)(ii), (iii.1), (v), (vi) or (xiv) of Class 43.1 in Schedule II to the Income Tax Regulations, ii. stationary electricity storage equipment that is described in subparagraph (d)(xviii) or (xix) of Class 43.1 in Schedule II to the Income Tax Regulations, but excluding equipment that uses any fossil fuel in operation, iii. active solar heating equipment, air-source heat pumps and ground-source heat pumps that are described in subparagraph (d)(i) of Class 43.1 in Schedule II to the Income Tax Regulations, iv. a non-road zero-emission vehicle described in Class 56 in Schedule II to the Income Tax Regulations and charging or refuelling equipment described in subparagraph (d)(xxi) of Class 43.1 in Schedule II to the Income Tax Regulations or subparagraph (b)(ii) of Class 43.2 in Schedule II to the Income Tax Regulations that in each case is used primarily for such vehicles, v. equipment used exclusively for the purpose of generating electrical energy or heat energy, or a combination of electrical energy and heat energy, solely from geothermal energy, that is described in subparagraph (d)(vii) of Class 43.1 in Schedule II to the Income Tax Regulations, but excluding any equipment that is part of a system that extracts fossil fuel for sale, vi. concentrated solar energy equipment, or vii. a small modular nuclear reactor. covered worker means an individual (other than a trust) a) who is engaged in the preparation or installation of specified property at a designated work site as an employee of an incentive claimant or of another person or partnership; b) whose work or duties in respect of the designated work site are primarily manual or physical in nature; and c) who is not i. an administrative, clerical or executive employee, or ii. a business visitor to Canada as described in section 187 of the Immigration and Refugee Protection Regulations. reduced tax credit rate means the regular tax credit rate minus 10 percentage points. regular tax credit rate means the specified percentage (as defined in subsections 127.44(1) and 127.45(1), as the case may be). |