Secure the Full Value of Your Tax Credit

…Through Compliance Implementation & Monitoring

A critical piece of a project’s economics going forward is obtaining the tax credit introduced in the Inflation Reduction Act (IRA).

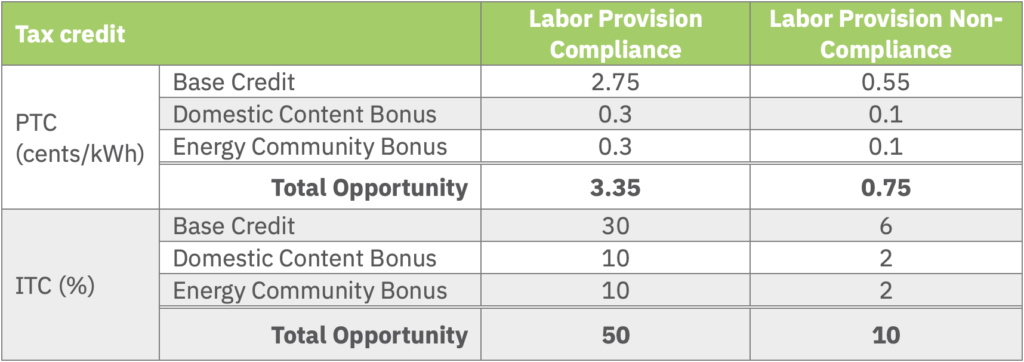

- Investment Tax Credit (ITC): provides a tax credit on business investments in renewable energy development in a given tax year.

- Production Tax Credit (PTC): provides a credit per kilowatt-hour (kWh) of electricity that is produced for the 10-year timeframe starting from the in-service date.

- Additional credit bonuses of 10% each are available for projects that meet specific Domestic Content requirements OR for siting a project in an Energy Community.

Example: 500MW portfolio, assumed to have development costs that exceed $500 million USD, obtaining full ITC and bonus credits would equate to an estimated tax credit value of $250 million USD.

The prevailing wage and apprenticeship provisions (the “labor provisions”) affect the value of the tax credit in two distinct ways:

- the base credit value, and

- any applicable bonus credit value(s).

Compliance with the labor provisions offers a 5x increased value to the base credit and bonuses.*

* Due to rounding to the nearest 0.05, as directed by the IRS Code, the PTC bonuses without compliance with the labor provisions are inflated from 0.06 cents/kWh to 0.1 cents/kWh.

With this much at stake, it’s critical for your investors that there is a structured and vetted approach to ensuring your Engineering, Procurement and Construction (EPC) contractor meets or exceeds the minimum requirements embedded in the Internal Revenue Code (IRC) requirements.

Example cont’d: for the 500MW portfolio, non-compliance with the labor provisions would represent a lost opportunity of $200 million USD.

Adjustments to the Compliance Requirements Over Time

The Internal Revenue Codes (IRC) 45, 45Y, 48, and 48E (“the Codes”) describe the compliance requirements to achieve the target tax credits for the production tax credit and investment tax credit, respectively, for projects placed in service after December 31, 2022 and after December 31, 2024, respectively. The compliance requirements change over time across the IRA requirements. The table below summarizes the changes to the compliance requirements over time.

- Prevailing Wage: The prevailing wage compliance requirements are maintained across the Codes for PTC & ITC and inherently require compliance with the current rates per locationality. The prevailing wages applied should be most recently determined by the Secretary of Labor, in accordance with subchapter IV of chapter 31 of title 40, United States Code. For the PTC, the compliance period is 10 years from the in-service date, whereas the ITC requires a 5-year period.

- Apprenticeship: The apprenticeship compliance requirements are maintained across the Codes for PTC & ITC with the required percentage of labor hours performed by qualified apprentices currently at 12.5% for projects beginning construction in 2023 and increasing to 15% for projects beginning construction in 2024 and after.

IMPORTANT: Each “contractor with 4+ employees performing construction, alteration, or repair work on a project shall employ 1 or more qualified apprentices to perform such work.” Consequently, the apprenticeship requirement cannot be concentrated to one contractor and must be shared across the on-site construction supply chain, as applicable.

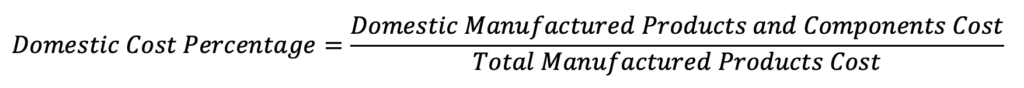

- Domestic Content: The Codes have the same or very similar compliance requirements for Domestic Content across PTC & ITC. The Adjusted Percentage, currently at 40%, sets the minimum required Domestic Cost Percentage for the project, calculation shown below. The Domestic Cost Percentage for the project must be greater than the Adjusted Percentage.

The Adjusted Percentage increases by 5% per year starting in 2025, to a maximum of 55% for projects beginning construction in 2027 and after.

The Codes indicate that permanent records must be kept, and that the Secretary reserves the right to audit throughout the life of the project. Ensuring that contractual requirements related to the IRA requirements are met across a portfolio of projects will require a structured and meticulous approach towards compliance, implementation, and record keeping.

Audit-proof your portfolio. Reach out to Compass Energy Consulting to learn more about how we can support your compliance plan, implementation, and record keeping.

A fulsome compliance plan and implementation approach necessitates a multi-phase approach that includes pre-assessment, process auditing, as well as on-going monitoring and reporting, and will form an insurance policy that the significant tax credit available is bankable for investors and project stakeholders. Compass’ approach incorporates the following 7 tasks:

Task 1 – Pre-Construction Compliance Planning: will focus on setting the groundwork for the compliance implementation, monitoring, and reporting. The Compliance Plan must be prepared with project specific inputs including construction and equipment supply chains chosen or contemplated. Contractual obligations will be identified, and specific language will be furnished for the EPC Agreements and passed down through subsequent supply chain agreements. Template labor hour timesheets will be prepared for use on-site, as well as determining sufficient qualified apprenticeship evidence.

Task 2 – Domestic Cost Percentage Determination: will include data requisition from specified supply chain vendors. The first step is to determine all Applicable Project Components. Table 2 of the IRS Guidance on Domestic Content provides a starting point for that list. Direct costs will be required from all Manufactured Product vendors and all sub-vendors that provide U.S. Manufactured Product Components. Compass Energy Consulting can act as a third party to the manufacturers so that cost information remains confidential. The compliance approach and target Domestic Cost Percentage will be determined in conjunction with the procurement plan to ensure it is greater than the adjusted percentage.

Task 3 – Annual Prevailing Wage Determination: will focus on the annual determination of the applicable prevailing wages for the construction, alteration, or repair work expected on-site for that calendar year. The prevailing wages will be set as most recently determined by the Secretary of Labor, in accordance with subchapter IV of chapter 31 of title 40, United States Code. This process will be required through construction and a portion of operation.

Task 4 – Monthly Compliance Reporting: will include monthly compliance progress reports on adherence to the labor provisions and Domestic Content requirements progress. The monthly reports will identify any gaps in compliance with applicable next steps to realign compliance.

Task 5 – Manufacturing Supply Chain In-Person and Desktop Audits: will focus on in-person auditing of selected equipment suppliers and service providers to ensure they are capable of both satisfying the contractual requirements embedded the IRC and have appropriate information management systems in place to be able to substantiate compliance. A report will be produced for each equipment supplier audit. The desktop audits will ensure that the records provided are complete and accurate by reconciling production, shipping, and invoice records with purchase orders. A structured data management system will be created to retain all records electronically. These records will form part of the Domestic Content Report and Audit Binder and remain as evidence of Domestic Content compliance in the event of an audit.

Task 6 – On-Site Project Audit: will include visiting the project site to ensure labor hour tracking compliance, retention of qualified apprenticeship evidence, and ensuring major equipment deliveries are being recorded appropriately to ensure traceability to U.S. production records.

Task 7 – Labor Provisions and Domestic Content Audit Binder: will include compiling and organizing all prevailing wage documentation, apprenticeship labor hour, and Domestic Content records required to sufficiently evidence that the requirements in the IRC have been met for the 30% base credit and 10% Domestic Content bonus credit.

Compass can offer flexible compliance support for your portfolio depending on which combination of base tax credit and bonus credits are pursued.

- Labor Provision Compliance

- Safeguard your full base credit value through compliance planning, implementation, and record keeping regarding prevailing wage and apprenticeship requirements.

- Labor Provision + Domestic Content Compliance

- Where you are looking to obtain the Domestic Content bonus credit in addition to the base tax credit; Safeguard your full base credit + bonus credit value through compliance planning, implementation, and record keeping regarding prevailing wage, apprenticeship, and Domestic Content requirements.

Compass is uniquely positioned to provide turn-key compliance, monitoring, and audit preparation due to our extensive experience with Domestic Content compliance, monitoring, and audit support from Ontario, Canada, which stipulated similar compliance requirements across supply chains.

Like the IRA requirements, the Ontario rules had both labour tracking and equipment manufacturer audit requirements. We completed Domestic Content auditing on over 200 MW of solar projects and as a result, developed a repeatable process that we can leverage to help assess compliance with the IRA requirements. We conducted over 50 manufacturing site audits throughout the solar supply chain in Ontario and are intimately familiar with the different major components and subcomponents that are used within each.

Compass Energy Consulting Relevant Experience

- Founded in 2011, Compass Energy Consulting has been providing regulatory and compliance support to the renewable energy industry throughout Canada and the Northeastern U.S. for over a decade.

- Over the last 6 years, Compass has supported Proponents in NYSERDA’s annual Tier 1 procurement, resulting in over 1GW of contract awards.

- This process of reviewing complex regulatory documents, establishing compliance requirements, and creating a compliance plan to implement, monitor, and record evidence is very much what we have done in other assignments, like the various Domestic Content Compliance engagements we have completed in the past.

NYSERDA’s Tier 1 RFP is known for its complex requirements, where our role is to review the RFP in detail and distill its requirements into discrete obligations for our clients providing strategic insight on exceeding the minimums.

Compass’ Support

Compass has managed the submission of nearly 1.5 GW of awarded projects in the Tier 1 procurements over the last five years. For more insights on NYSERDA’s Tier 1 procurements, reach out directly to myself at rachelle@compassenergyconsulting.ca to see where we can best support your goals in New York.

Rachelle Lynne-Davies, P.Eng.

Associate Director

Compass Energy Consulting

rachelle@compassenergyconsulting.ca

—